From animal shelters to food banks to healthcare organizations, nonprofits of all verticals need more than just monetary support. It takes a combination of tangible resources, intangible assets, and financial flexibility to drive your organization’s mission, which is why the in-kind donation is so powerful.

In-kind donations play a pivotal role in supporting nonprofit missions by reducing overhead costs, meeting beneficiaries’ needs, and otherwise providing valuable and necessary resources. To help you tap into these benefits, we’ve compiled everything you need to know about in-kind donation solicitation and accounting, including:

- What is an in-kind donation?

- How to solicit noncash gifts

- How to record and report in-kind donations

- Tips for streamlining donation collection and reporting

A thorough understanding of this type of contribution empowers your nonprofit to pursue and properly manage in-kind gifts to drive your mission forward.

What is an in-kind donation?

An in-kind donation is a non-monetary donation, including goods and services, given to a nonprofit by individuals or for-profit organizations. Also referred to as Non-Cash Gifts by the Internal Revenue Service (IRS), these resources may be given freely or at a discounted rate. Conversely, the donor might pay for the good or service on the nonprofit’s behalf.

These contributions should be relevant to your nonprofit’s mission and accounted for according to their fair market value (FMV), meaning your organization must be diligent when requesting, accepting, and recording them. Since noncash gifts refer to any asset donated other than funds, there is a vast range of donation types your organization may receive.

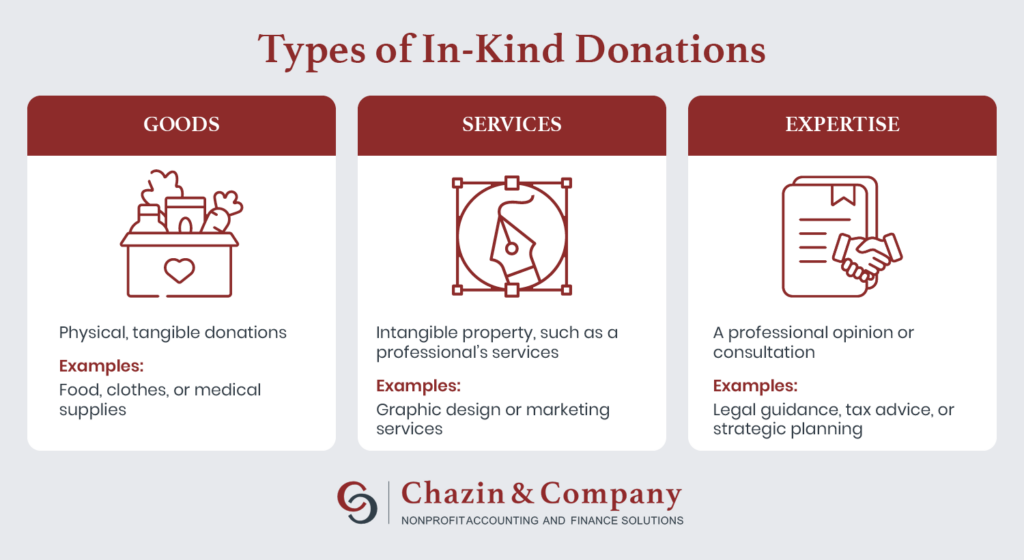

What are the different types of in-kind donations?

In-kind donations can be broken down into the following categories:

- Goods: This includes physical, tangible donations that can either be given directly to beneficiaries or used by your nonprofit to fulfill its mission. This is an especially popular form of in-kind support, with 81% of donors contributing food or other goods to nonprofits. For example, an animal shelter might receive in-kind donations of pet food, toys, treats, and bedding.

- Services: A donation of volunteered time, typically from a professional, can be categorized as services. For example, a professional photocopying service may print brochures for your upcoming fundraiser.

- Expertise: Instead of offering their services, some professionals may provide your nonprofit with their expertise by serving as a consultant. For example, a professional may offer legal guidance, tax advice, or strategic planning at no cost to your nonprofit.

Nonprofits may receive every type of in-kind donation or only a few, depending on the organization’s mission, the gifts that would drive it forward, and the scope of its giving programs.

How do nonprofits use them?

Depending on the type of gift, nonprofits can use in-kind contributions for a variety of operational needs. Commonly, these gifts are used to support core programs and services. For example, a food bank may use donated food items to feed families in need. However, these donations may also cover operational needs, like kitchen supplies to cook with or tables for a dining area to serve meals.

Other gifts can provide support for more specific initiatives, such as fundraising expenses or marketing needs. For example, nonprofits may receive access to an event venue for free, which can be used to host a fundraising gala or auction.

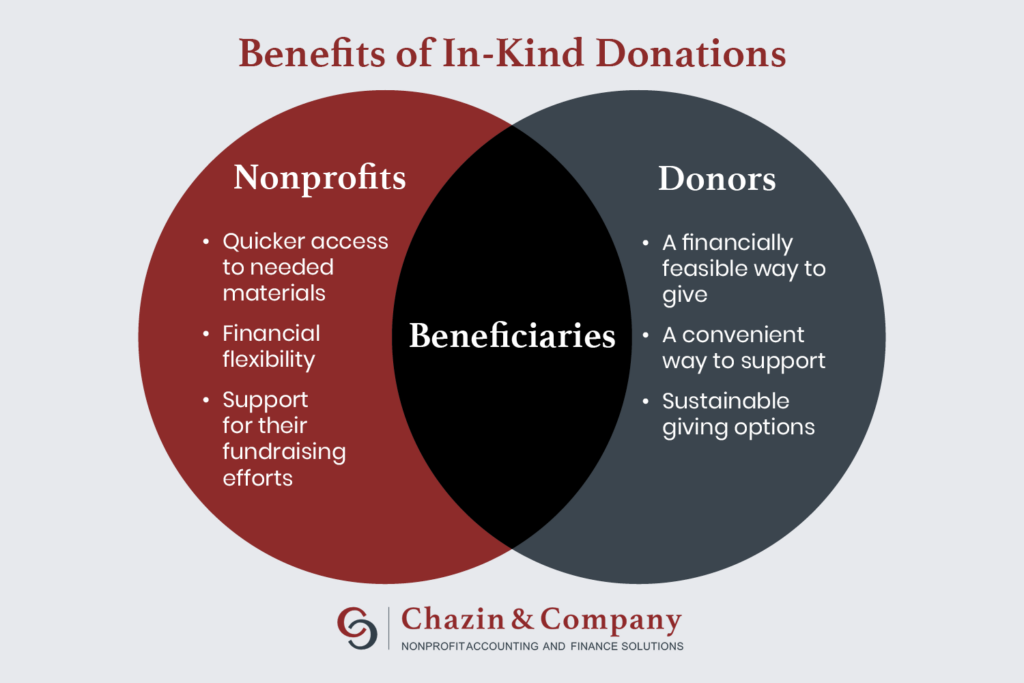

What are the benefits of in-kind support?

Nonprofits and donors alike stand to benefit from in-kind contributions.

For nonprofits, these gifts provide:

- Quicker access to needed materials, such as resources needed for programs or general operations that aren’t yet affordable.

- Financial flexibility, since in-kind donations free up a nonprofit’s monetary resources for other needs, such as building your operating reserves.

- Support for their fundraising efforts when donors give relevant goods and services like event venues or catering services.

Donors, on the other hand, benefit from:

- A financially feasible way to give, since they can donate without breaking the bank.

- A convenient way to support, especially for organizations with access to relevant goods or services, like a marketing firm’s ability to promote a fundraiser.

- Sustainable giving options, including opportunities to recycle gently used goods.

However, the biggest benefactors of in-kind giving are your nonprofit’s beneficiaries. By driving your mission forward, these gifts benefit the individuals and communities you serve.

How to solicit noncash gifts

Asking for in-kind support involves knowing what to ask for, who to ask, and how you’ll accept these gifts.

Create a wishlist of needed goods and services.

Determine what types of in-kind gifts your nonprofit needs and create a specific wishlist to share with potential donors. For example, a healthcare organization might include the following on its wishlist:

- Goods: Medical supplies, equipment, and personal care items

- Services: Volunteered time from medical professionals and translators to facilitate communication with patients who speak other languages

- Expertise: Insights from healthcare experts and public health professionals

When listing your nonprofit’s needs, include any necessary context or notes. Following the example above, a healthcare organization may only accept personal care items of a specific brand.

Ask for in-kind donations in your fundraising appeals.

Create a dedicated page on your nonprofit’s website to explain in-kind contributions and display your donation wishlist. Then, incorporate this wishlist into your marketing materials to spread the word. For example, you could ask for these donations on the following channels:

- Email newsletters

- Social media

- Individual letters

When reaching out to donors individually, personalize your appeal by speaking to the donors’ previous involvement. You might ask a recurring donor to donate a good in lieu of their monthly cash donation, for example. Or, a lapsed donor might be inclined to re-engage with your nonprofit if you request a good or service.

Partner with willing companies and corporations.

Depending on the type of donation, corporate sponsors may be better positioned to meet your fundraising needs than individual donors. For example, a local restaurant could cater your fundraising gala, but likely wouldn’t have the resources to donate gently used clothing items for your beneficiaries.

Craft a marketing campaign that reaches corporate partners with specific information about what you need and how they can donate. Include any benefits the company may receive in return, such as brand promotion at your fundraising event.

Develop a gift acceptance policy.

Although in-kind support can cover a wide range of gifts, your nonprofit may not be able to use every donation. For example, a healthcare organization can’t accept expired medication or opened packages of medical supplies.

How should your nonprofit decline gifts like these without seeming ungrateful to donors who mean well? Develop a gift acceptance policy that outlines:

- Acceptable gifts

- The condition of acceptable gifts, like new or gently used

- Gifts that can’t be accepted

- The circumstances for gift acceptance

- The procedure for recording these gifts

These guidelines simplify the gift acceptance process for your nonprofit and increase the likelihood that you’ll receive helpful gifts when donors know exactly what you’re looking for.

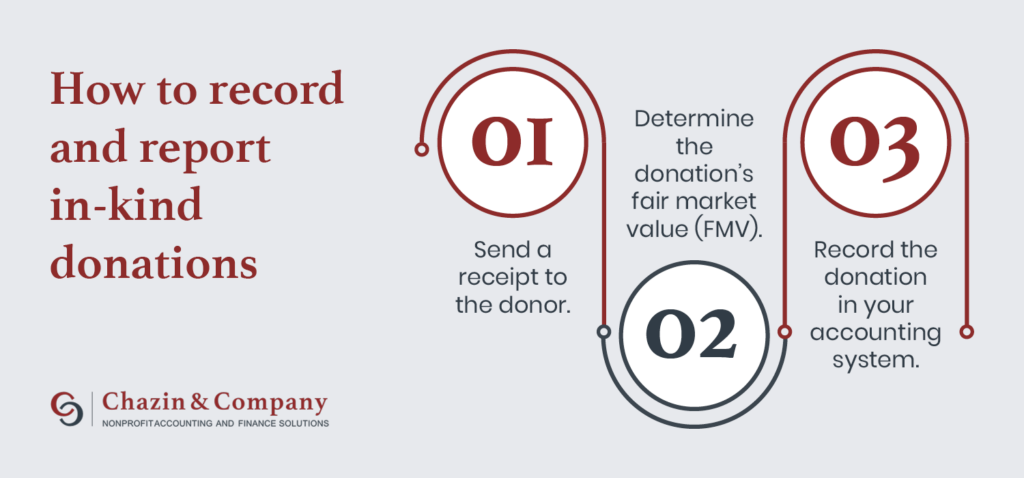

How to record and report in-kind donations

Because in-kind support comes in many different forms, recording and reporting these gifts can be difficult. However, proper accounting for these contributions is necessary for tax reporting, state regulation compliance, meeting the Generally Accepted Accounting Principles (GAAP), and surviving a financial audit.

While specific types of gifts will require more complex steps, the following foundational steps can help you cover the essentials:

1. Send a receipt to the donor.

Donation receipts are required for both monetary and noncash donations, but there are specific requirements for in-kind gift receipts. According to the IRS, “a contemporaneous written acknowledgment” is necessary for gifts valued at $250 or more before donors can claim a charitable deduction on their federal income tax returns. These acknowledgments should include:

- Your nonprofit’s name

- A description of the contribution

- The date the donation was made

- A quid-pro-quo statement confirming the organization did not provide anything in exchange for the donation

The receipt or acknowledgment should not include an estimate of the fair market value. If your nonprofit did provide goods or services in exchange for the donation, you must also detail their value and note whether you provided intangible religious benefits.

2. Determine the donation’s FMV.

Fair market value (FMV) refers to the value of a good or service if it had been purchased by your nonprofit rather than donated. Since in-kind support should be recorded as revenue, this value is crucial for accurately recording and reporting the value of these donations.

To find an item or service’s FMV, there are a few sources you can check:

- The donor: Check with the donor to determine the value of an item or service.

- Major retailers: Research the typical price of an item by visiting the websites of major retailers.

- Similar providers: Contact providers of similar goods or services to get a general idea of the donation’s value.

For high-value donations, your nonprofit may need a professional appraisal. For example, you should consult an independent appraiser to determine the value of donated real estate or artwork.

3. Record the donation in your accounting system.

In your nonprofit’s chart of accounts, designate a separate revenue account for in-kind donations. Record each gift as revenue at fair value, but input its net value as zero since your nonprofit’s cash reserve doesn’t change. This process can be complex, so follow these steps to approach record-keeping efficiently:

- Record in-kind support immediately. Prompt record-keeping ensures your books accurately reflect your financial activity at all times. Additionally, you’ll be sure that every donation is accounted for by continually recording donations rather than catching up on your record-keeping after an extended period of time.

- Record the donation’s value in its functional expense account. For example, the expense side of a donation of marketing services should be recorded as Professional Services.

- Record the donation’s value in its separate revenue account. Following the example above, marketing services could be recorded under In-Kind Gifts – Services.

To ensure you accurately record these gifts, you may outsource accounting to a professional. This way, your books will be in the hands of a trustworthy professional while you focus on what matters most: your mission.

Tips for streamlining donation collection and reporting

Handling every step of in-kind contributions, from soliciting to reporting them, is like adding a full-time workload to your nonprofit’s operations. To ensure these gifts support your work without taking away from your mission-centric activities, streamline the process with the following resources:

- Automated communications: Various nonprofit marketing tools can help your organization garner in-kind support without having to manage a completely new marketing campaign. For example, email marketing software can automate email newsletters so that your content sends by itself. These platforms can even segment recipient lists to ensure you send relevant messages to the right audience. Additionally, certain donation tools can automate receipts for online cash donations, allowing you to focus on in-kind gifts while your tech does the work for other contributions!

- E-commerce: Open an e-commerce store on your nonprofit’s website that hosts your goods and tangible items in-kind contribution wishlist. This way, donors can easily browse and purchase the exact items you need.

- Volunteer management software: Use a platform dedicated to volunteer management to track and record the hours donated by your supporters. This can help volunteers keep track of their hours, too, in case they want to report their time donated for opportunities such as volunteer grants. An experienced outsourced nonprofit accounting firm will help you determine which volunteer hours and services can be recorded as in-kind gifts.

- Outsourced accounting: Nonprofit accountants are professionals in the field and familiar with the requirements and best practices for handling these gifts. Relying on professional nonprofit accounting services provides your organization with professional expertise in valuing, recording, and reporting every type of donation, as well as strategic advice for budgeting and making the most of your donors’ contributions.

In general, outsourced accounting is the most efficient way to manage in-kind donations. A professional accountant can assist with every aspect of your nonprofit’s finances to ensure both in-kind and cash donations are recorded and used properly. As a result, your nonprofit will see increased financial efficiency and still retain the time and resources needed to drive its mission forward.

For example, Chazin supplemented the internal team at St. Columba’s Episcopal Church with greater nonprofit accounting expertise to:

- Streamline their chart of accounts

- Provide monthly reconciliations and financial statements

- Offer ongoing finance analysis and counsel

With the help of professional accounting expertise, St. Columba’s Episcopal Church saved $150,000 per year on finance-specific expenses and achieved a 70% increase in finance efficiency.

Additional resources on in-kind donations

Diversify your nonprofit’s revenue sources by soliciting and collecting in-kind contributions. Once you’ve established a wish list and gift acceptance policy and the donations start rolling in, consult a nonprofit accountant to handle the rest of the process.

In the meantime, explore the following resources to keep growing your nonprofit accounting knowledge:

- Streamlining Audits With PBC Checklists: What You Need To Know. In-kind contributions are just one of many financial factors you’ll need to include if your nonprofit is approaching an audit! Learn how to prepare with a checklist in this guide.

- Key Audit Strategies For Nonprofits: Ensuring A Smooth And Uneventful Audit. Beyond knowing what to provide, there are some key strategies your nonprofit can employ to ensure your audit goes smoothly. Check out our list of key strategies.

- The Crucial Role Of A Nonprofit Board Treasurer. Navigating Finances For A Purposeful Future. Nonprofit board treasurers hold the key to financial stability and sustainability. Explore their responsibilities in our comprehensive guide.