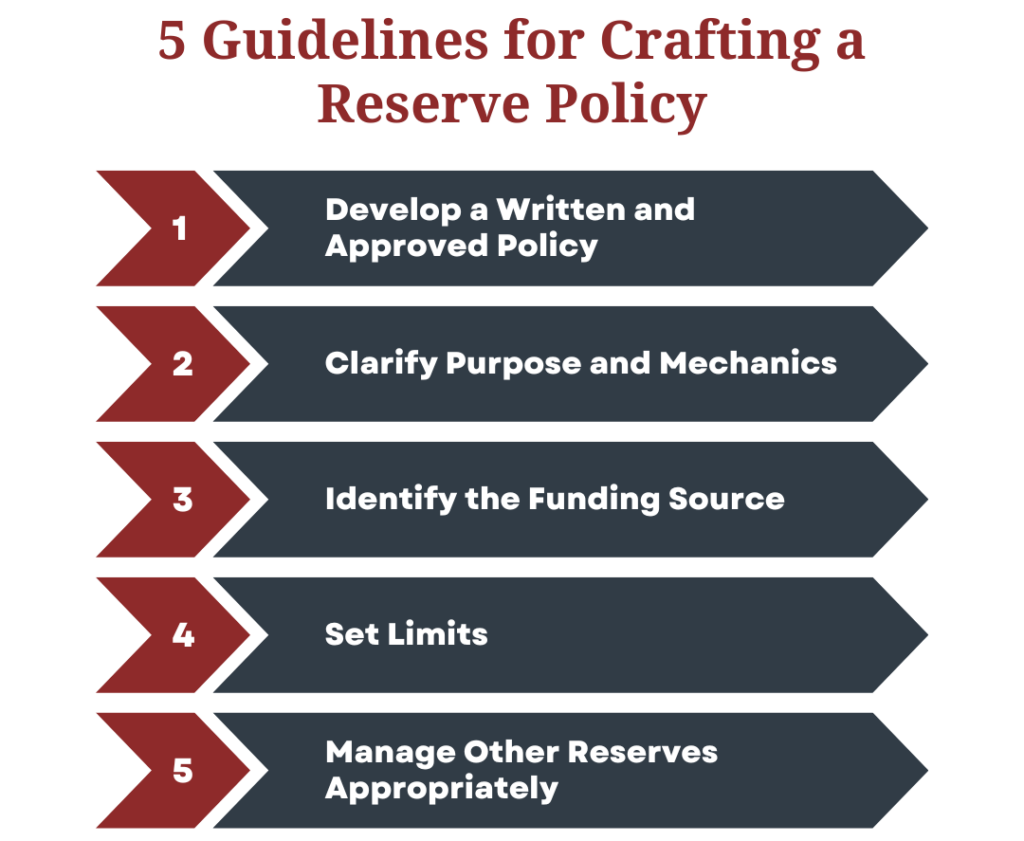

For nonprofits, it is essential to sustain a consistent cash flow to fulfill obligations. Establishing an operating reserve serves as a strategic measure, offering a safety net against unforeseen events that could temporarily impact cash flow. Here are five key practices to consider when developing your operating reserve policy, ensuring its effectiveness and availability when needed.

#1: Develop a Written and Approved Policy

Merely having an operating reserve is insufficient. A crucial step involves developing and adopting a written policy. This process is invaluable, aligning the board of directors and leadership team on definitions, calculations, and procedures. A formalized policy sets a foundation for clarity and accountability.

#2: Clarify Purpose and Mechanics

Your operating reserve policy should outline not only the high-level purpose and goals of the reserve but also the mechanics of its maintenance. Key elements to include are:

- Purpose of building and maintaining reserves

- Definitions of reserve types, intended use, and calculation of target amounts

- Assignment of authority for utilizing each reserve fund, potentially delegating some authority to staff leaders

- Responsibilities for reporting reserve fund amounts and usage

- Any specific policies on the investment of reserve funds

#3: Identify the Funding Source

Operating reserve funds can stem from various sources. Grants, donations, or gradual accumulation from unrestricted surpluses are common methods. Clearly define in your policy how the operating reserve will be funded. If surpluses contribute, specify the portion of excess cash allocated to the reserve fund. Consider including a budget line item for regularly adding funds to the reserve.

#4: Set Limits

Establishing the size of your operating reserve is crucial. While a common guideline is three to six months’ worth of expenses, adapt this figure based on your organization’s specifics. Long-term contracts providing stable funding may require a smaller reserve, while nonprofits reliant on periodic grants or seasonal programs may need a larger buffer. Periodic reviews can assess the adequacy of your goals in light of funding changes.

#5: Manage Other Reserves Appropriately

If additional reserves, like a “Capital Reserve,” are in your plans, develop separate policies for each. Customize each policy to address essential components unique to different reserves. Avoid assuming that a single policy can cover all reserve types, ensuring clarity and adherence to specific requirements.

By following these guidelines, you’ll be well on your way to creating a robust operating reserve policy that safeguards your nonprofit against financial uncertainties.

Share This Post:

Chazin

With over 20 years working exclusively with nonprofits, we pride ourselves in having a unique understanding of nonprofit accounting needs. We believe that nonprofits deserve personalized, quality service and should not settle for a one-size-fits-all approach. We collaborate with you to provide a fully virtual and customized solution that is not only cost-effective but also strengthens your accounting function. We offer a team of industry experts at your disposal to provide advice, leading technology, and to supplement existing staff to improve efficiency and compliance.