No matter your nonprofit’s mission or cause, your activities are supported by a silent but critical backbone: nonprofit accounting. Behind every nonprofit initiative is meticulous bookkeeping, budgeting, and financial reporting to make the most of limited resources.

Whether your organization promotes animal welfare or responds to natural disasters, your focus is on making an impact. Let’s explore how you can maximize that impact with effective accounting practices. This guide will cover:

- What is Nonprofit Accounting?

- Nonprofit Accounting Best Practices

- Compliance Requirements for Nonprofit Accounting

- Outsourced Accounting for Nonprofits

To help you get more value out of your resources, let’s discuss the basics of nonprofit accounting and beyond.

What is Nonprofit Accounting?

Nonprofit accounting is the system in which nonprofits plan, track, and report their financial activities to efficiently manage their programs and activities. To fulfill their missions (and their duty to transparently report their financial activity) nonprofits must follow a unique set of accounting rules and processes.

Nonprofit vs. for-profit accounting

Because of their mission-centric organizational structure, nonprofits operate very differently from for-profit organizations. This is especially true of accounting, an area in which these organizations have differing goals.

For-profits plan, track, and report their financial activities with the goal of making a profit. In contrast, nonprofit accounting involves allocating funds effectively across operational goals to achieve their mission while demonstrating accountability to donors and other stakeholders.

Accountability is a key aspect of nonprofit finances, especially when handling restricted funds or adhering to grant rules. You must ensure that you use funds for their intended purposes, which is why nonprofits generally employ a unique type of accounting.

Fund accounting

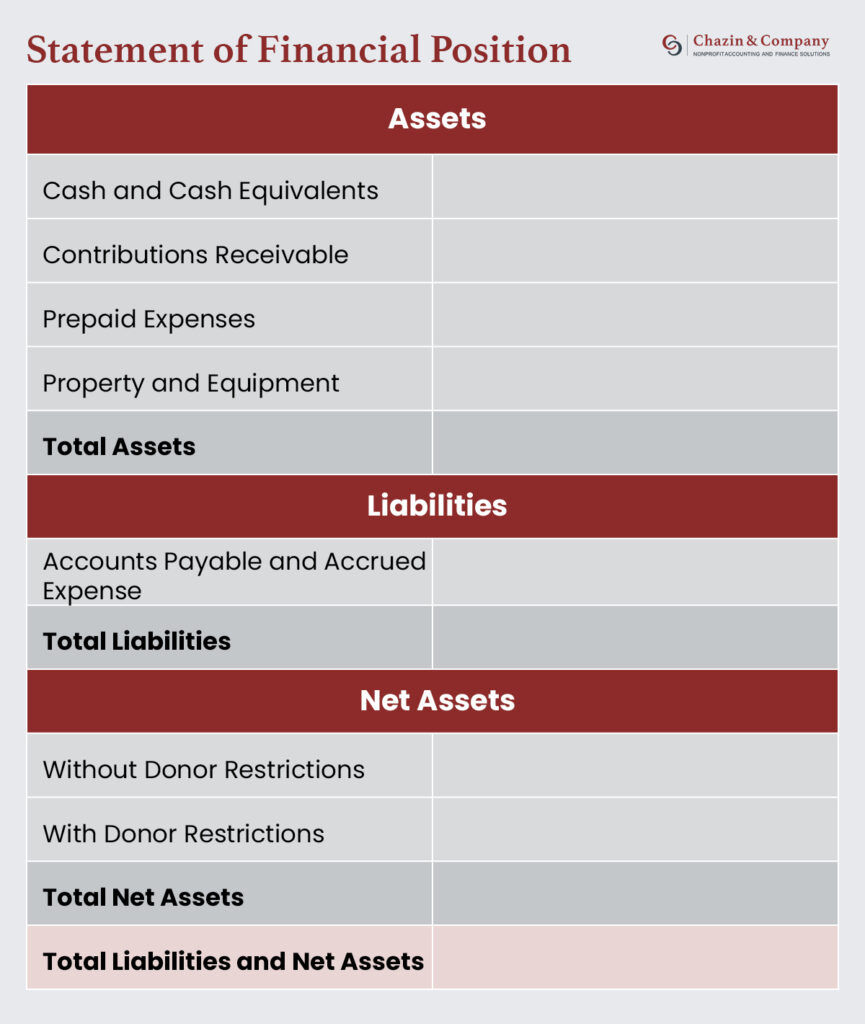

To maintain financial transparency, most nonprofits use a method called fund accounting, which involves allocating resources into separate funds according to their intended purposes. Each fund has its own classification depending on its source and purpose. These classifications make it possible for a nonprofit to track the revenue and expense for a specific initiative, program, grant, etc. which demonstrate how the nonprofits resources are allocated. In addition, funds received must also be categorized into one of the following net asset categories:

- Without Donor Restrictions (May include Board Designated Funds)

- With Donor Restrictions

In the Statement of Financial Position, these categories show the amount of net assets available for any purpose compared to the net assets available only for restricted purposes.

Not only does this system enhance financial transparency, but it also empowers nonprofits to manage their funds effectively while adhering to the specific restrictions placed on them.

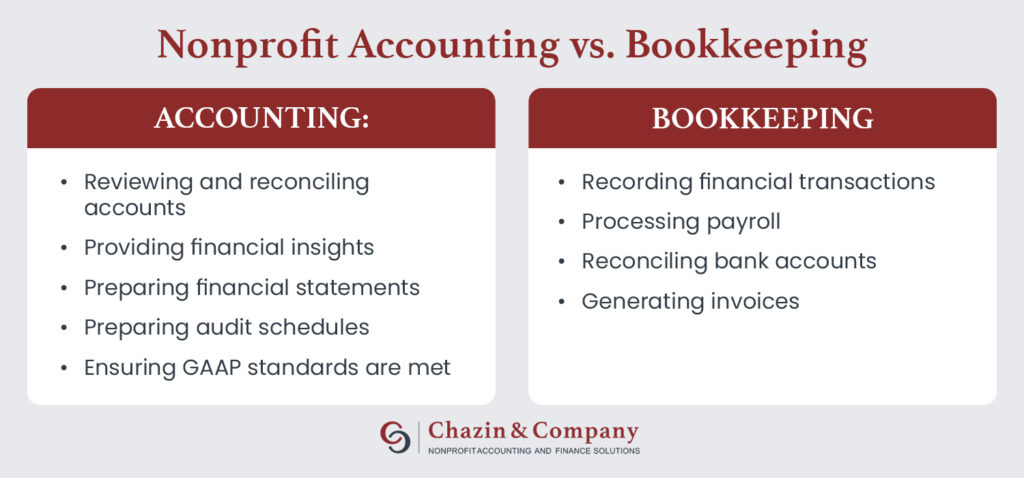

Accounting vs. bookkeeping

When talking about managing funds, you might hear the terms “accounting” and “bookkeeping” used interchangeably. However, these concepts are far from synonymous—bookkeeping is the process of recording financial transactions, while accounting involves analyzing key data and reports to make informed financial decisions.

Here are the major differences between the two:

Nonprofit accounting involves the following tasks:

- Reviewing and reconciling accounts: This involves checking over all accounts by comparing ledger entries to bank statements or other financial documents, then investigating and resolving any discrepancies. This ensures that records are correct and helps to prevent errors or fraud from occurring.

- Providing financial insights: Accounting offers valuable insights from the trends, opportunities, and challenges reflected in your financial data. These insights provide the perspective necessary to assess your nonprofit’s financial health and create a plan for improving it.

- Preparing financial statements: Your nonprofit’s financial data is the core component of its financial statements, which provide an overview of your financial position. These documents empower your stakeholders to understand your organization’s financial activities.

- Preparing Audit Schedules:Engaging in an annual external audit is an important step in establishing credibility and transparency for a nonprofit. The PBC list provided by the auditor requires that data be presented in specific formats to facilitate the audit process.

- Ensuring GAAP standards are met: The Generally Accepted Accounting Principles (GAAP) are the guidelines that ensure your financial reporting is accurate and complete. Your nonprofit’s accounting approach should meet these standards by implementing checks and balances and keeping thorough records.

Bookkeeping, on the other hand, involves:

- Recording financial transactions

- Processing payroll

- Reconciling bank accounts

- Generating invoices

While these roles are very different, both are important for your nonprofit’s financial health. You’ll need to understand the differences in these responsibilities to delegate the tasks accordingly. For example, bookkeepers typically don’t require specialized education, while most accountants must have a four or five-year degree at a minimum.

Also, appointing these tasks to an existing team member may be difficult since 18% of nonprofits list staffing as their greatest challenge. Instead, outsourcing the task to a professional with ample experience in nonprofit accounting can be highly beneficial to your team’s productivity and result in cost savings.

Nonprofit Accounting Best Practices

It’s no mystery that nonprofits require specialized accounting practices, such as fund accounting, to effectively manage their financial resources. This unique accounting structure has recently garnered increasing attention from researchers and requires tailored strategies to employ properly.

Use the following best practices as a starting point for your nonprofit’s finances.

1. Use quality accounting software configured for your nonprofit.

As we discuss in our list of resolutions every nonprofit should make, technology is a powerful tool for helping your nonprofit evaluate its financial and mission-centric goals. In the same way that an accountant needs specialized education and nonprofit experience, your accounting software must be set up specifically to address nonprofit financial reporting and requirements.

Accounting software that’s configured correctly for your nonprofit will provide useful data that informs your team’s decision making through:

- Resource tracking: Your accounting software must be equipped to track and categorize all the resources at your nonprofit’s disposal. Also, this functionality supports compliance with reporting requirements since it tracks all the data necessary to report in tax filings.

- Fund accounting: To properly manage your diverse revenue streams, such as donations, program revenue, grants, and non-cash gifts, your software must follow your nonprofit’s system of tracking and allocating revenue.

- Financial reporting: Reporting functions enable your nonprofit to apply its data to financial statements, board reports, and more. With clear and informative reports, your nonprofit can produce customized reports that address the specific needs of your organization and its stakeholders.

Additionally, accounting software can be configured to integrate with your nonprofit’s other tools, such as CRM systems and grant management platforms. With an organized system, your nonprofit can access and utilize numerous data points for a comprehensive approach to financial management.

2. Enforce strong internal controls.

Whether or not you use accounting software to manage your nonprofit’s financial activity, error is always a possibility. Delegate your nonprofit’s accounting responsibilities to a handful of qualified, trustworthy team members. Then, implement strong internal controls to safeguard the accounting process, such as separating accounting duties and limiting authorization.

Standardizing these tasks and providing clear expectations for each role helps to protect your financial data against errors. Additionally, these procedures can help your nonprofit prevent fraud or mismanagement.

3. Reconcile, reconcile, reconcile.

Reconciliation is the cornerstone of sound financial management. Regularly reconciling bank statements, investment accounts , and all other asset and liability accounts across systems helps in detecting discrepancies early on. It’s not just about balancing numbers but also about ensuring that every transaction is accounted for and legitimate. This practice is not simply a routine task but a vital health check for the financial well-being of your nonprofit.

4. Conduct external audits regularly.

In addition to your internal accounting processes, your nonprofit should use external resources to increase accountability and financial integrity. Organize your financial records, such as receipts, invoices, and grant agreements. Then, choose an independent auditor or audit firm to examine your financial records and evaluate your compliance.

Conduct external audits regularly to ensure the upkeep of your financial information. Implement any recommendations you receive from the auditor that could enhance your accounting processes and encourage your team to be audit-ready at all times.

5. Educate your staff and board.

Even if they aren’t directly involved in your nonprofit’s accounting processes, your team as a whole, including your board, should understand your nonprofit’s accounting approach. This equips every team member with the insight needed to make informed decisions that align with your financial goals. Also, it cultivates a cohesive work environment in which teams can work together to meet all organizational priorities.

Keep staff and board members in the loop by holding regular accounting training sessions and workshops. Additionally, you can incorporate a rundown of your nonprofit’s accounting approach into your onboarding program for new staff members to ensure that every employee knows their role in the organization’s financial transparency.

Compliance Requirements for Nonprofit Accounting

GAAP

The accounting standards established by GAAP provide the framework for both for-profit and nonprofit financial management. The official ten principles include:

- Principle of Regularity: GAAP-compliant accountants strictly adhere to established rules and regulations.

- Principle of Consistency: Consistent standards are applied throughout the financial reporting process.

- Principle of Sincerity: GAAP-compliant accountants are committed to accuracy and impartiality.

- Principle of Permanence of Methods: Consistent procedures are used in the preparation of all financial reports.

- Principle of Non-Compensation: All aspects of an organization’s performance, whether positive or negative, are fully reported with no prospect of debt compensation.

- Principle of Prudence: Speculation does not influence the reporting of financial data.

- Principle of Continuity: Asset valuations assume the organization’s operations will continue.

- Principle of Periodicity: Reporting of revenues is divided by standard accounting periods, such as fiscal quarters or fiscal years.

- Principle of Materiality: Financial reports fully disclose the organization’s monetary situation.

- Principle of Utmost Good Faith: All involved parties are assumed to be acting honestly.

This system ensures your financial documents are accurate, trustworthy, and translatable across a variety of audiences, including grantors and auditors. Create a comprehensive plan for implementing these standards into your daily financial activities so your team can identify any areas for improvement.

Statements and Reports

As we discussed earlier, effective nonprofit accounting involves creating thorough financial statements and reports to provide an overview of your financial position. Let’s go over the types of financial documents you’ll need to create.

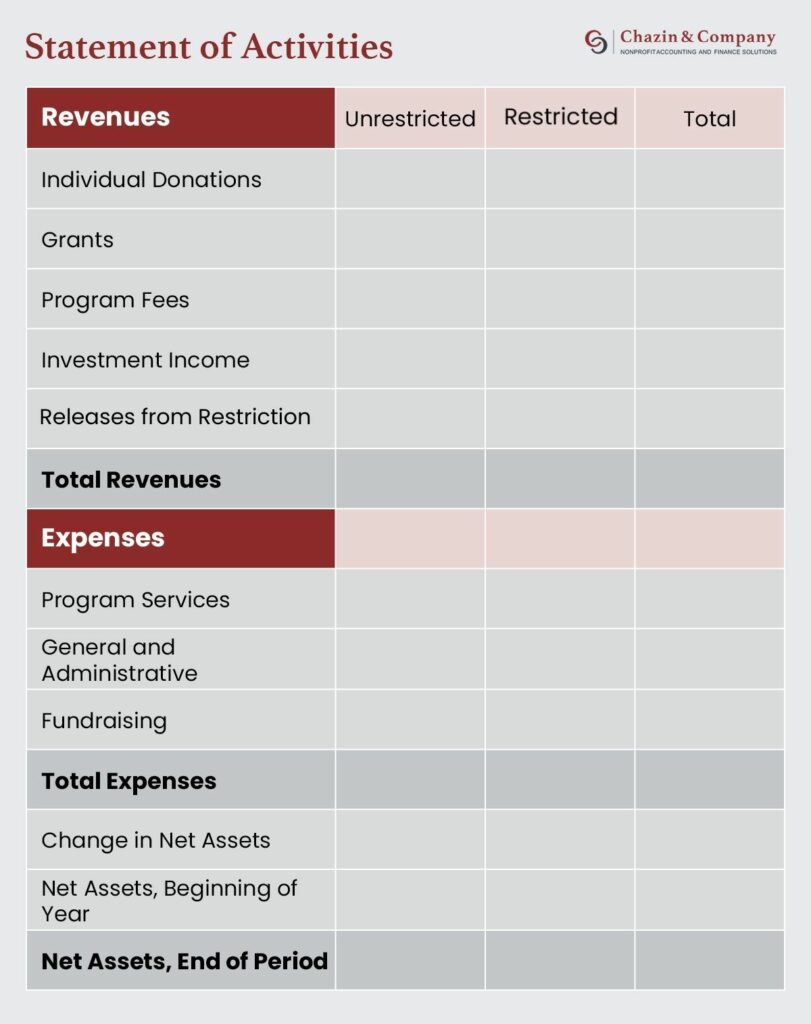

Statement of Activities

First, your nonprofit may develop a broad overview of its revenue and expenses. The statement of activities, or income statement in the for-profit world, categorizes your diverse revenue sources and expenses, and then compares your total revenues to total expenses.

Your statement of activities might look similar to this example:

Statement of Financial Position

The statement of financial position, similar to the for-profit balance sheet, lists your nonprofit’s assets and liabilities. This data allows you to calculate your net assets, which helps you gauge your nonprofit’s financial health.

Here’s an example of what your statement of financial position may look like:

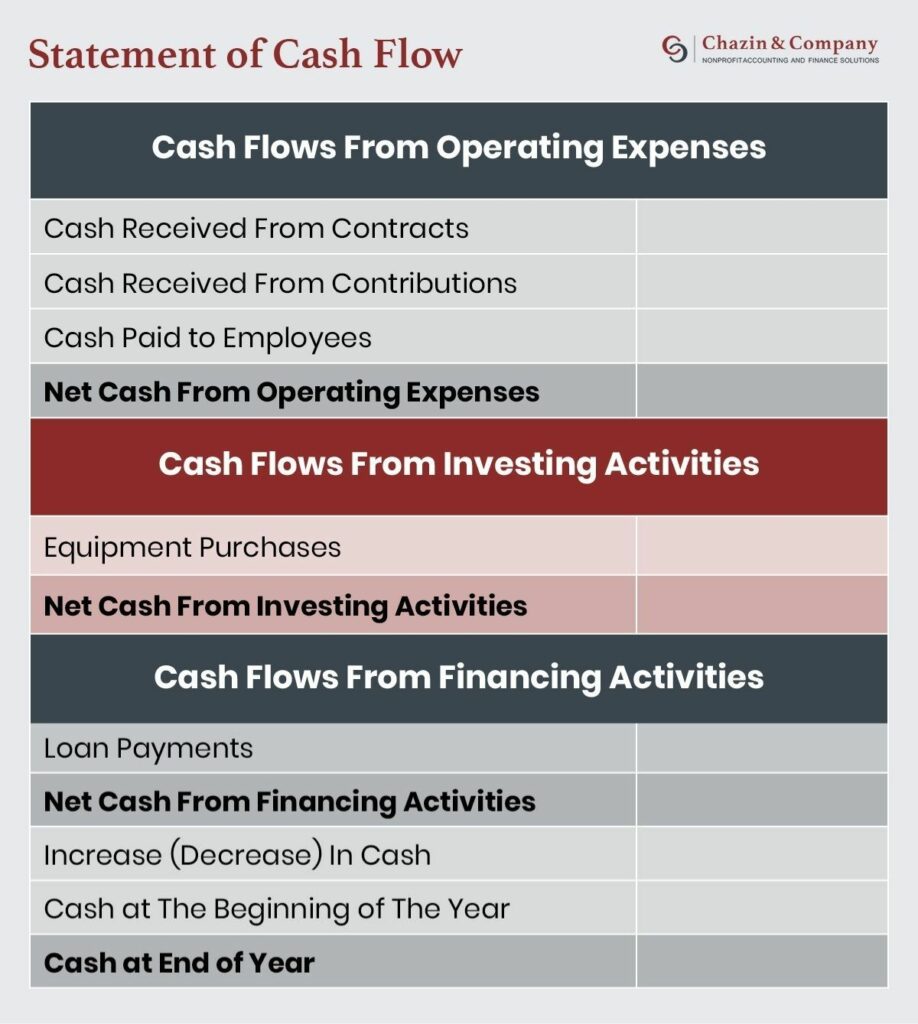

Statement of Cash Flow

Focusing on your nonprofit’s revenue, the statement of cash flow details the organization’s inflows and outflows of cash. This categorizes cash flow according to its source and reveals how much cash is available to cover your expenses to the organization.

A statement of cash flow might mimic the following example:

Cash Flow Projections

Using historical financial data, nonprofits can forecast their future financial positions with cash flow projections. These predictions estimate an organization’s incoming and outgoing cash over a specific time period.

Cash flow projections are essential to ensuring an organization can meet its financial obligations and take proactive measures against potential cash shortages. Additionally, it can help your nonprofit ensure its budget lines up with its strategic plan by providing a clear picture of available funds.

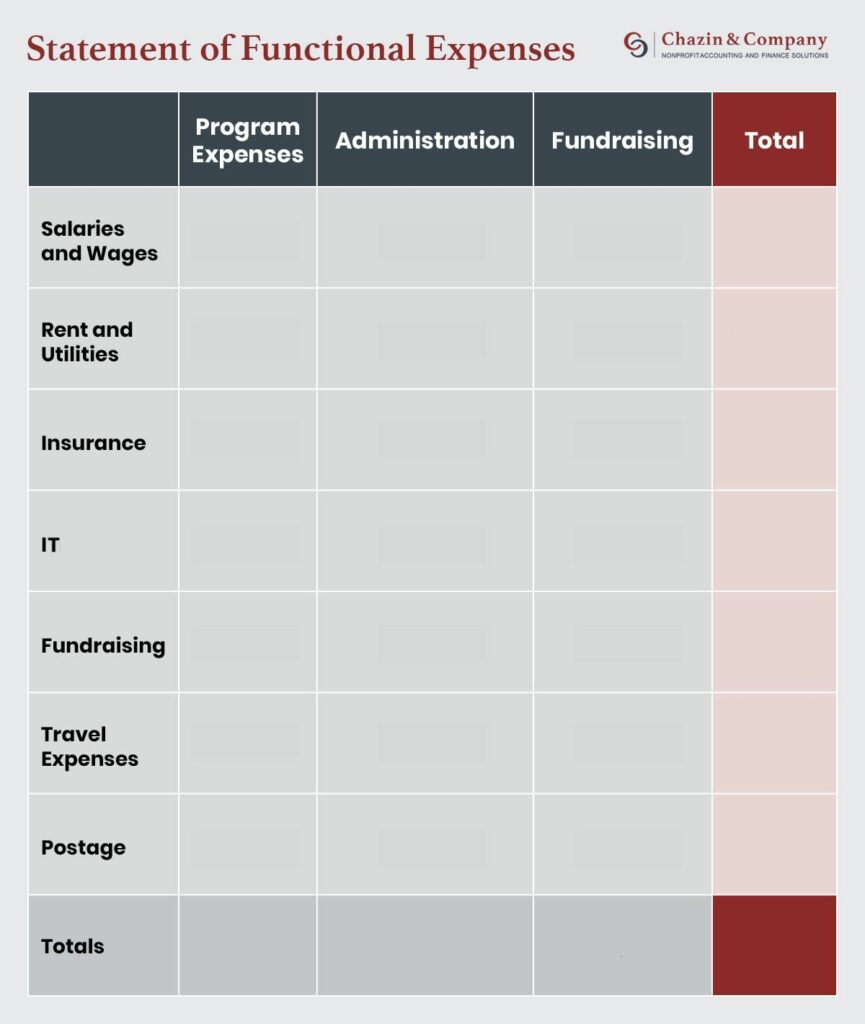

Statement of Functional Expenses

As with the statement of cash flow, a statement of functional expenses focuses in on one aspect of your nonprofit’s budget: its expenses. A requirement for annual audits, this worksheet categorizes expenditures according to their operational functions.

Your statement of functional expenses might look something like this:

Outsourced Accounting for Nonprofits

Many factors influence your nonprofit’s unique financial situation. While the tips in this guide provide a starting point, your nonprofit must employ an accounting approach tailored to its financial activity, records, and goals to effectively manage its resources.

However, you’ll also need a knowledgeable and experienced team to exercise accounting best practices and maintain compliance for your organization. Outsourcing accounting to a third-party expert is a surefire way to obtain a professional’s guidance without taking your team’s focus away from your mission.

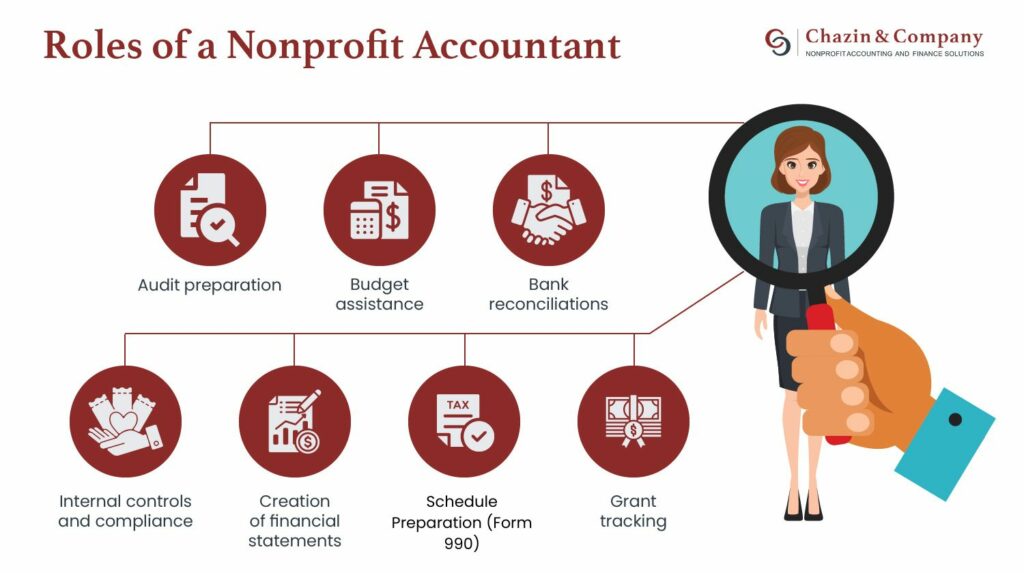

If you choose to outsource, look for a nonprofit accountant who provides the following services:

- Audit preparation

- Budget assistance

- Bank reconciliations

- Internal controls and compliance

- Creation of financial statements

- Schedule Preparation (Form 990)

- Grant tracking

Relying on professional nonprofit accounting services will provide convenience for your team and expertise to maximize your nonprofit’s resources. Plus, you can have peace of mind that your nonprofit’s finances are in the hands of a reliable expert.

Final Thoughts on Nonprofit Accounting

Understanding the nuances of nonprofit accounting is a crucial part of crafting an effective approach for your organization. However, enlisting the expertise of a professional can streamline the process for your organization and provide valuable insights for your team.

If you’re interested in learning more about nonprofit accounting, check out the following resources:

6 Nonprofit Accounting Best Practices To Be Thankful For. Your plan for handling your nonprofit’s finances should be framed around accounting best practices. Dive deeper into the top accounting strategies in this guide!

Mastering Nonprofit Budgeting: A Crucial Guide For Financial Health And Mission Fulfillment. Fund allocation is an important element of accounting as it affects your financial health and, ultimately, your ability to fulfill your mission. Take a closer look at nonprofit budgeting here.

Mastering Financial Transparency: How To Report Fundraising Expenses Correctly. Nonprofit accounting involves tracking and reporting various expenses, and fundraising activities are a significant source of expenses for many organizations. Learn how to transparently report fundraising expenses in this guide.