For nonprofits, accurate financial reporting is instrumental for organizational accountability, donor trust, and long-term sustainability.

Nonprofit leaders must ensure strong and accurate reporting to fulfill their fiduciary responsibilities. This guide covers key insights every nonprofit should know, including:

- Why Nonprofits Need Accurate Financial Statements

- A Detailed Breakdown of the 4 Nonprofit Financial Statements

- How to Create Financial Statements for Nonprofits

While familiarizing yourself with these statements is essential for maintaining accurate records, ultimately, the most reliable way to manage your finances is to partner with a professional accountant. As you read through this guide, consider the value of an accountant’s expertise in navigating these complexities.

Why Nonprofits Need Accurate Financial Statements

Nonprofit financial statements showcase fiscal responsibility to stakeholders, instill trust in donors and grantors, and support your team’s strategic planning.

They are more than just beneficial; they’re required for almost all 501(c)(3) organizations in the form of the 990 tax returns.

Nonprofit financial reporting requirements frequently change, so nonprofit teams must stay up-to-date to maintain compliance. In recent years, governing bodies have implemented a few new accounting standards that impact both nonprofits and their auditors.

Here are a few current regulations that must be considered when creating nonprofit financial statements:

The Financial Instruments Credit Losses standard (ASU 2016-13)

Otherwise known as the Current Expected Credit Loss (CECL) model, the Financial Instruments Credit Losses standard (ASU 2016-13) enhances the timeliness of credit loss recognition on financial assets.

This primarily affects for-profit entities but may be applicable to those nonprofits that have (to name a few examples):

- Trade receivables

- Loans/notes receivable (excluding those from related party entities)

- Held-to-maturity debt instruments

Note that it is not applicable to contributions and pledges receivable.

What does this mean for nonprofit financial statements? Nonprofits must review their financial statements to determine if they have any of the affected assets and then calculate, document, and record an allowance as a credit loss expense, ensuring that the process adheres to the new guidelines.

Statements on Auditing Standards (SAS) 143 and 145

Although Statements on Auditing Standards primarily affect the audit firms performing your audit, they can have ramifications for you:

- SAS 143: This standard mandates auditors complete a detailed risk assessment process for accounting estimates. This necessitates greater transparency and accountability when documenting those estimates, including the fair value of donated goods or services and grant revenue recognition.

- SAS 145: This standard requires auditors to evaluate an entity’s internal controls more closely. Therefore, nonprofits must place more emphasis than ever on their internal controls to ensure that they are effective and implemented in a manner consistent with their policies and procedures.

What does this mean for nonprofit financial statements? Proper documentation and processes are increasingly vital, not just for financial data but also for tracking who handles that data and how. Many nonprofits are challenged with limited resources that can make strong internal controls seem like an impossibility. Accounting professionals can help you strengthen them within your budgetary limitations.

A Detailed Breakdown of the 4 Nonprofit Financial Statements

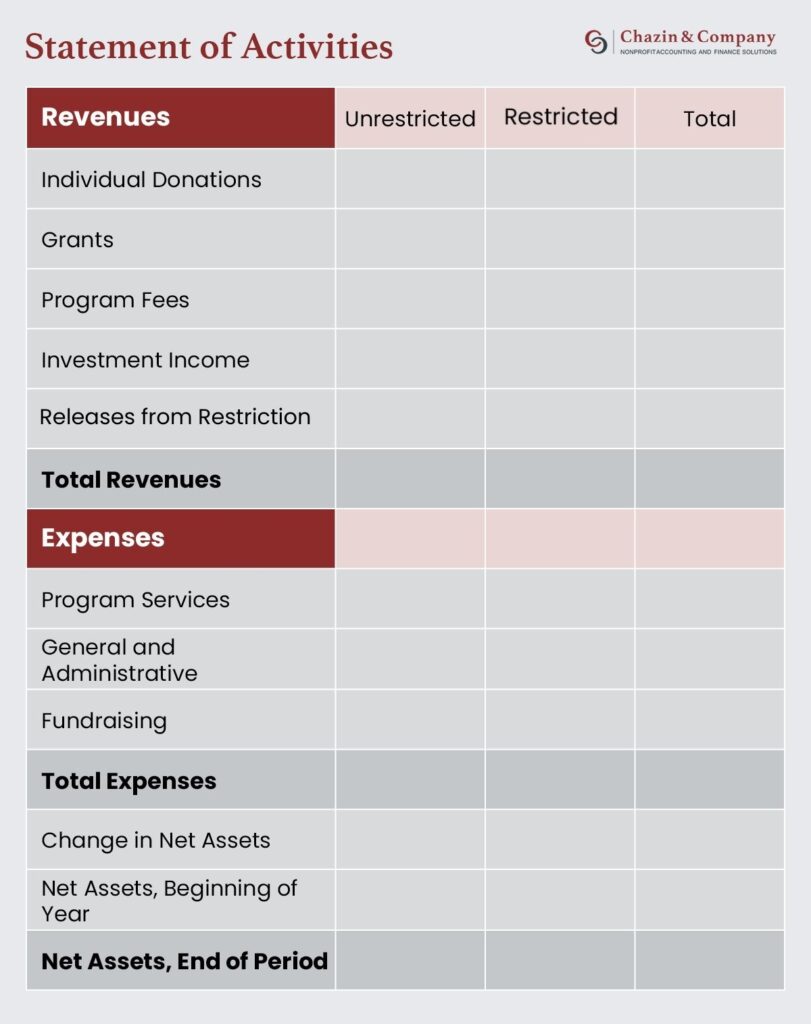

Statement of Activities (Nonprofit Income Statement)

The Statement of Activities, otherwise known as the nonprofit income statement, categorizes revenue sources and expenses and subtracts one from the other. That difference is known as the change in net assets. It is similar to net income on a for-profit Income Statement.

When analyzing the Statement of Activities, nonprofit leaders can look for financial growth by identifying positive changes in net assets where revenue exceeds expenses.

It should be noted that revenue recognition is an area of risk because there are unique recognition requirements for some sources of revenue, such as grants, contributions, and even event-related income.

Follow these tips for compiling the Statement of Activities:

- Regularly review Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), if you are subject to the latter, to ensure your financials are in compliance. This is management’s responsibility, not the auditor’s responsibility.

- Leverage financial management technology. Accounting software built for nonprofits will add a high degree of automation to the transactional demands that go into creating financial statements. Aside from resulting in a more efficient process, using such software also will reduce the risk of human error.

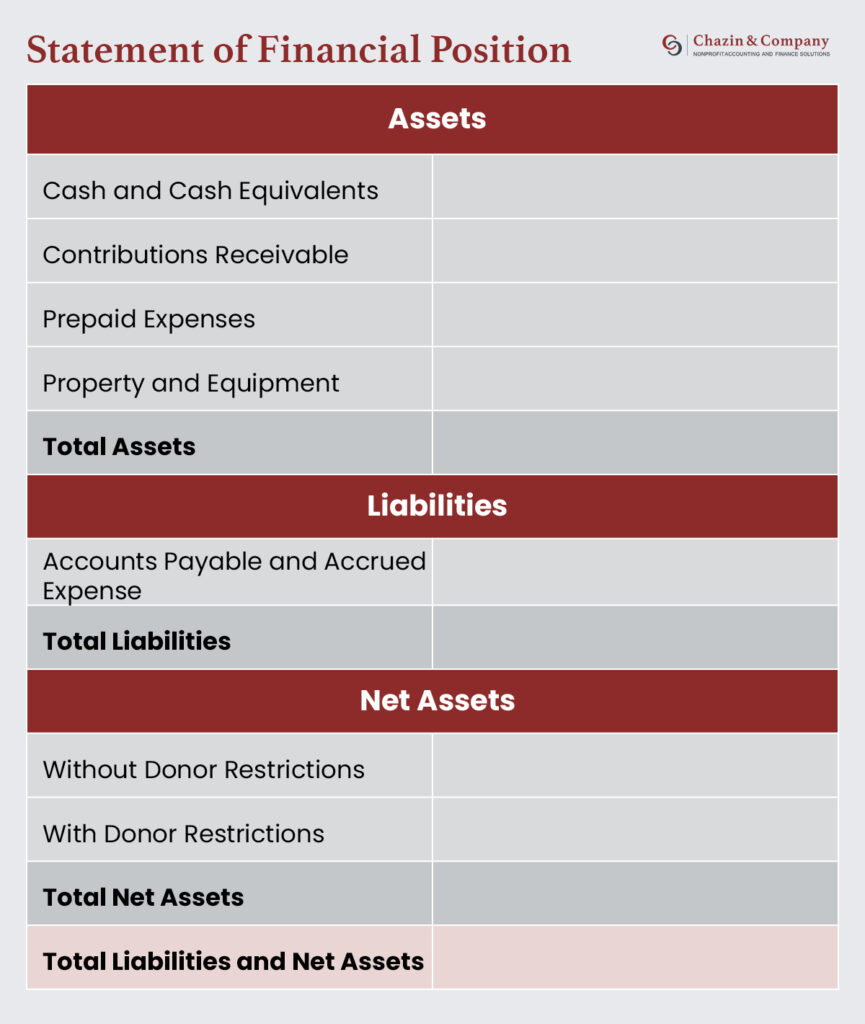

Statement of Financial Position (Nonprofit Balance Sheet)

The Statement of Financial Position, also known as a nonprofit balance sheet, lists a nonprofit’s assets and liabilities and calculates the organization’s net assets.

This data is drawn from the organization’s general ledger. Here’s how the information breaks down:

- Assets are listed in order of their liquidity (their ability to be converted into cash).

- Liabilities are listed in order of the length of obligation.

- Net assets with donor restrictions are listed separately from those without.

When reviewing the Statement of Financial Position, nonprofit leaders should compare assets and liabilities over time to identify financial growth and challenges. Positive net assets can indicate financial health; however, even that needs to be measured against the percentage of those net assets that are without donor restrictions.

Follow these tips for compiling this nonprofit financial statement:

- Closely track restricted and unrestricted funds. This is critical to ensuring that funds are spent consistent with the donors’ intent. Meticulous record-keeping ensures you properly report restricted and unrestricted funds. Accurate documentation for restricted funds is absolutely necessary and not negotiable. It helps to avoid accidental misuse.

- Reconcile, reconcile, reconcile. Double-check your Statement of Financial Position to ensure the numbers make sense and are well supported with documentation that is accurate. This is especially crucial for identifying discrepancies.

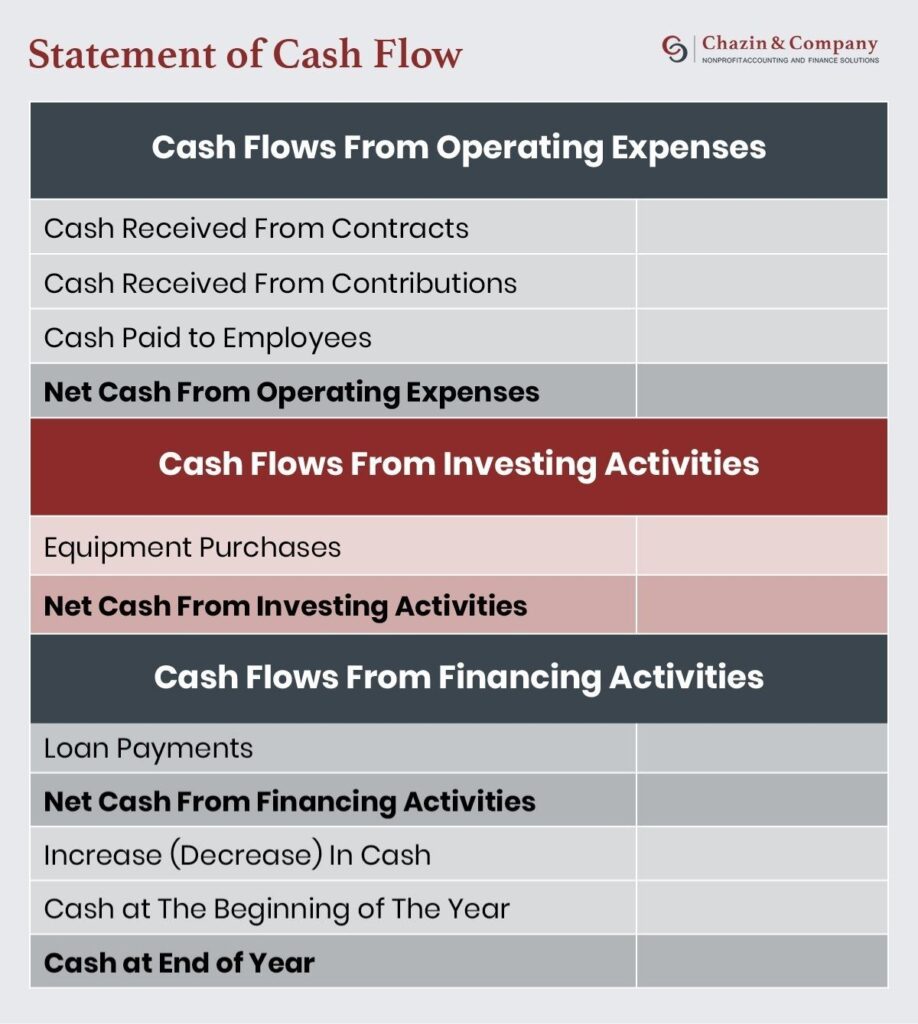

Statement of Cash Flow

The Statement of Cash Flow categorizes cash flow according to its sources and uses:

- Net cash flows from operating activities refer to your nonprofit’s core business activities, such as fundraising and payroll.

- Net cash flows from investing refers to transactions such as purchases and sales of fixed assets or marketable securities.

- Net cash flow from financing refers to transactions related to loans or endowments, to name a few

Trends across activities in this nonprofit financial statement can be interpreted in different ways. For example, nonprofit leaders may feel that a positive cash flow from operating activities means their organization is in good financial health.

To make strong use of this document, follow these tips:

- Compare the report to your Statement of Financial Position. Identify discrepancies by ensuring your opening and closing cash balances match the Statement of Financial Position’s cash and cash-equivalent balances.

- Share it with constituents. The Statement of Cash Flows is a great resource for showing off your responsible use of donations because it gives a detailed view of how funds are generated and spent. Provide data from this statement in your impact report or highlight it on your website to showcase your activities.

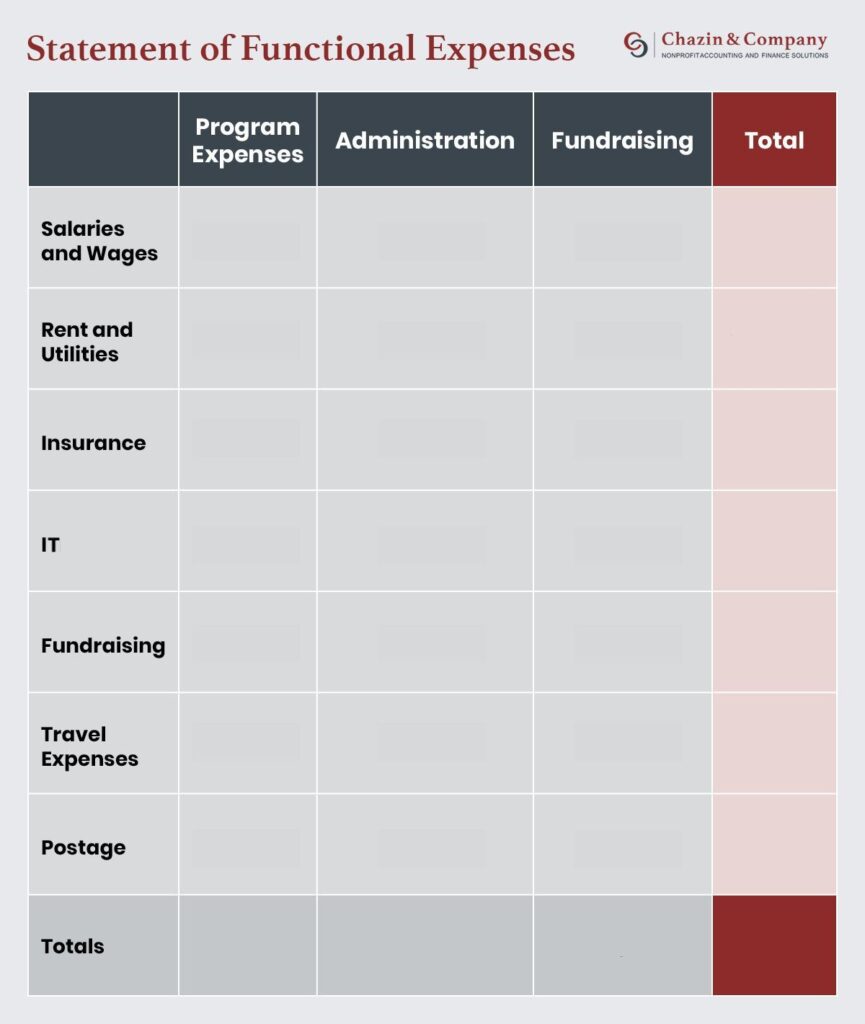

Statement of Functional Expenses

The Statement of Functional Expenses categorizes expenditures according to mission, fundraising, or general and administrative.

This financial report may be used by organizations like Charity Navigator and GuideStar to rate your organization. Additionally, it’s a great way to show stakeholders how expenses are distributed.

A high percentage of total expenses directed toward programs indicates a nonprofit is mission-focused and efficiently uses its resources to achieve its goals.

To compile this nonprofit financial statement, follow these tips:

- Assign all expenses to the appropriate functional category. Effective bookkeeping requires tracking different expenses throughout the year and categorizing them correctly.

- Document the basis for allocation methods. Recording the methodology behind expense allocation ensures consistent reporting for future fiscal years.

How to Create Financial Statements for Nonprofits

In addition to the aforementioned tips for each financial statement, follow these steps to ensure a seamless reporting process.

1. Consult a Professional Accountant

Compiling data, reconciling accounts, and properly structuring each financial statement is both time-consuming and extremely complex. Since most nonprofit professionals aren’t well-versed in nonprofit accounting practices, their organizations need someone experienced and knowledgeable to ensure their financial reporting follows appropriate requirements.

If your nonprofit is like most, the team is likely passionate about its mission, rather than its money. And the nonprofit sector’s recent workforce shortage crisis makes it difficult for organizations to recruit qualified individuals for any position let alone an in-house accountant.

Yet, a professional nonprofit accountant can ensure that you are provided with meaningful, accurate data to help guide the decisions you make every day. Outsourcing to professional expertise means you’ll receive the guidance you need concerning nonprofit financial reporting regulations, compliance concerns, and more.

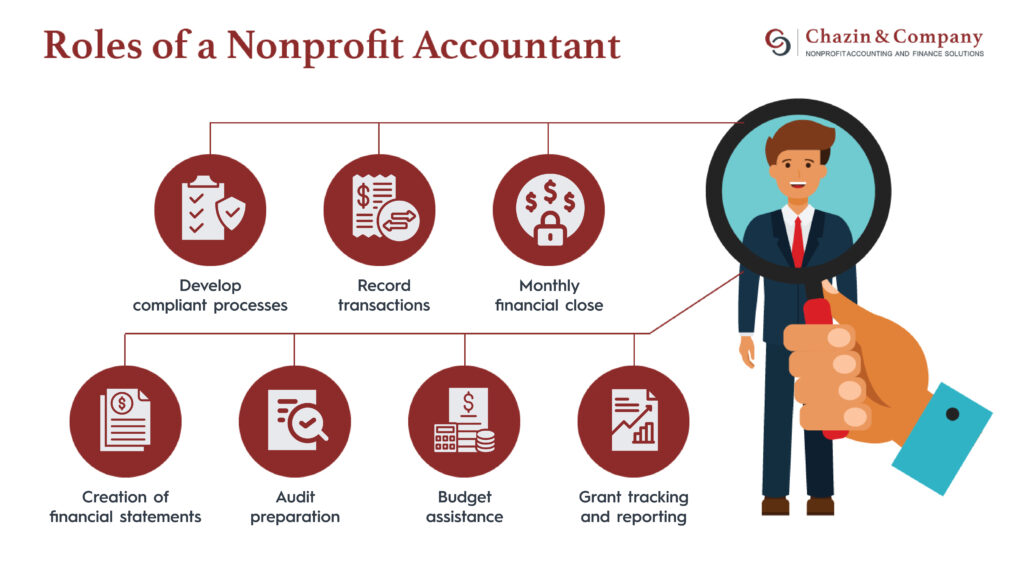

When outsourcing accounting, a few essential services to look for include:

- Developing compliant processes

- Recording transactions

- Completing monthly financial close

- Creating financial statements

- Preparing for an audit

- Budgeting

- Tracking and reporting grants

The best way to ensure accurate financial statements is by working with a seasoned nonprofit accounting firm, like Chazin. Our team has decades of experience creating financial statements for nonprofits of all sizes, and we offer a full suite of services to catalyze nonprofits’ financial success.

One such example is our work with Special Olympics Tennessee (SOTN). Chazin & Company implemented processes, controls, efficiencies, and a new accounting application to address SOTN’s financial needs.

The team at Chazin has always been responsive and knowledgeable. They focused on producing the dashboard and reports we need to effectively run the organization. They also train our team as needed on the Sage Intacct accounting software. Their work is always done efficiently and accurately resulting in transparent and easy to read financial statements.

Adam Germek, President and CEO of SOTN

2. Provide clarification whenever possible

Accurate and well-organized data is the foundation of reliable nonprofit financial statements. These reports should help your team and its stakeholders understand the organization’s finances.

Final Thoughts on Nonprofit Financial Statements

Creating financial statements is one step in the accounting process, but it must be preceded by strong financial practices. Partnering with a professional accounting firm, like Chazin, ensures your team can efficiently and accurately report its financial activity.

For more information on proper accounting practices, check out the following resources:

- A Board Member’s Guide to Investment Oversight: You know how to report investments in your financial statements, but do you know how to manage them? Explore the role of your organization’s leadership in supervising your investment activities.

- Nonprofit Accounting Best Practices to be Thankful For: Discover best practices beyond nonprofit financial reporting in this roundup of accounting standards.

- Mastering Financial Transparency: How to Report Fundraising Expenses Correctly: Take a closer look at expense categorization and reporting in this complete guide.