Running a nonprofit organization comes with unique challenges that demand impeccable financial management. From budgeting and grant reporting to compliance and stakeholder stewardship, managing the financial side of a nonprofit can be a daunting task. While many nonprofits rely on internal accounting staff to handle these responsibilities, there are instances when supplementing them with outsourced nonprofit accounting experts can prove to be a game-changer.

Let’s explore the situations in which outsourcing makes perfect sense and how it can address specific pain points, ultimately leading to greater efficiency and greater impact for the organization.

The Role of Nonprofit Accounting

Before diving into the reasons for outsourcing nonprofit accounting, let’s first understand the vital role that accounting plays in a nonprofit’s operations. Efficient financial management is the backbone of any nonprofit, enabling them to allocate resources strategically, adhere to regulatory requirements, and maintain transparency with stakeholders.

However, many nonprofits face several challenges that can strain their internal accounting departments, leading to potential errors, inefficiencies, and missed opportunities. These challenges include:

Limited Resources

Nonprofits often have limited funds and personnel, making it challenging to invest in comprehensive accounting software, training, and dedicated financial staff.

Complex Reporting

Nonprofit accounting involves unique financial reporting requirements, such as fund accounting and grant reporting, which can be complex and require specialized expertise.

Compliance and Regulations

Nonprofits must adhere to strict regulations and maintain transparency to maintain their tax-exempt status. Keeping up with changing laws and accounting standards can be burdensome for internal teams.

Seasonal Demands

Accounting tasks may fluctuate throughout the year, with peak periods during monthly close, audit preparation, annual report development, or grant reporting deadlines, putting additional strain on internal staff.

Talent Shortage

Attracting and retaining accounting professionals with expertise in nonprofit accounting can be challenging due to the limited pool of candidates.

Risk Mitigation

Errors in financial reporting or compliance issues can damage the reputation of a nonprofit and jeopardize its ability to secure funding.

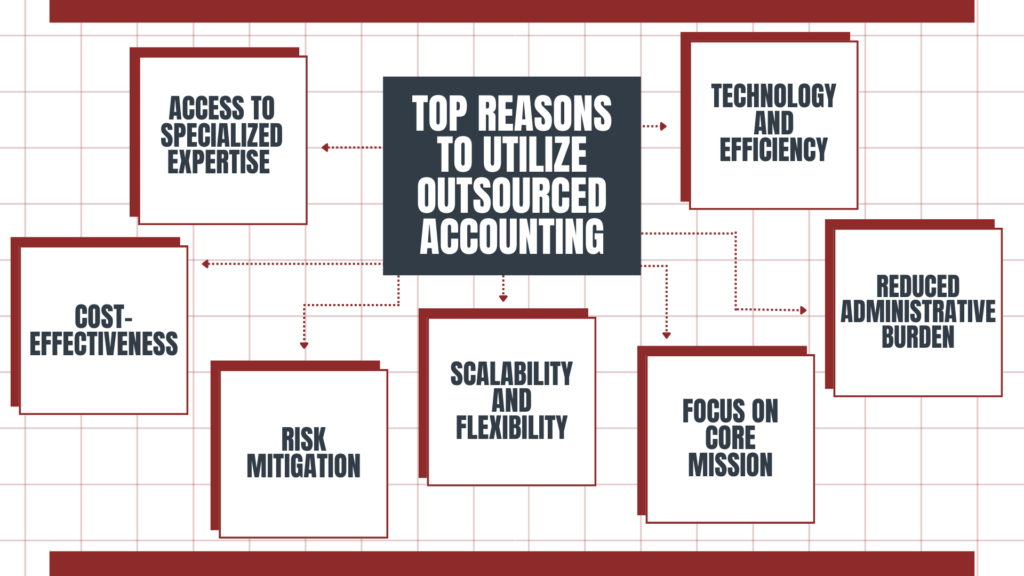

Outsourcing Nonprofit Accounting: The Cure for your Pain Points

Access to Specialized Expertise

Outsourcing provides access to a team of professionals with specialized expertise in nonprofit accounting and finance. These experts are well-versed in the intricacies of fund accounting, grant reporting, and nonprofit compliance requirements. Their experience and knowledge can help ensure accurate financial reporting, ultimately boosting the organization’s credibility and stakeholder trust.

Cost-Effectiveness

For many nonprofits, hiring and training an in-house accounting team can be costly. Outsourcing allows organizations to access the expertise they need without bearing the full cost of maintaining a full-time accounting department. Outsourced services can be tailored to the nonprofit’s needs, whether it’s a specific project or ongoing support, making it a manageable and cost-effective solution.

Scalability and Flexibility

Nonprofit accounting demands can fluctuate throughout the year, leading to periods of high demand. Outsourced accounting services offer scalability, allowing nonprofits to ramp up or down their accounting support as needed. This flexibility ensures that the organization has the right level of expertise when they need it the most, without the burden of maintaining a full-time staff during leaner periods.

Reduced Administrative Burden

Managing an internal accounting department involves administrative tasks like hiring, training, and providing employee benefits. By outsourcing accounting functions, nonprofits can alleviate this administrative burden and focus on their core mission and programmatic activities.

Technology and Efficiency

Reputable nonprofit accounting firms utilize modern accounting software and tools that streamline processes and improve efficiency. Nonprofits can benefit from the latest technologies and streamlined workflows without the expense of implementing and maintaining these systems themselves.

Risk Mitigation

Outsourcing nonprofit accounting can significantly reduce the risk of errors and compliance issues. Expert accountants are well-versed in the latest accounting standards and regulations, ensuring accurate financial reporting and adherence to legal requirements.

Focus on Core Mission

By outsourcing accounting functions, nonprofit leaders and staff can concentrate on their core mission and programmatic activities. Redirecting time and energy away from financial management enables them to dedicate more resources to serving their communities and advancing their cause.

Outsourcing nonprofit accounting can be a strategic decision that addresses specific pain points faced by nonprofit organizations. By tapping into the expertise of specialized accounting professionals, nonprofits can overcome challenges related to limited resources, complex reporting, compliance, and talent shortages. Moreover, outsourcing provides cost-effectiveness, scalability, flexibility, and access to modern technology, ultimately leading to greater efficiency and impact for the organization.

While outsourcing may not be the solution for every nonprofit, organizations should consider their specific needs, budget, and long-term goals before making a decision. In many cases, the benefits of outsourcing nonprofit accounting can outweigh the costs of maintaining an internal staff allowing nonprofits to thrive financially and focus on making a lasting difference in their communities.

Share This Post:

Chazin

With over 20 years working exclusively with nonprofits, we pride ourselves in having a unique understanding of nonprofit accounting needs. We believe that nonprofits deserve personalized, quality service and should not settle for a one-size-fits-all approach. We collaborate with you to provide a fully virtual and customized solution that is not only cost-effective but also strengthens your accounting function. We offer a team of industry experts at your disposal to provide advice, leading technology, and to supplement existing staff to improve efficiency and compliance.