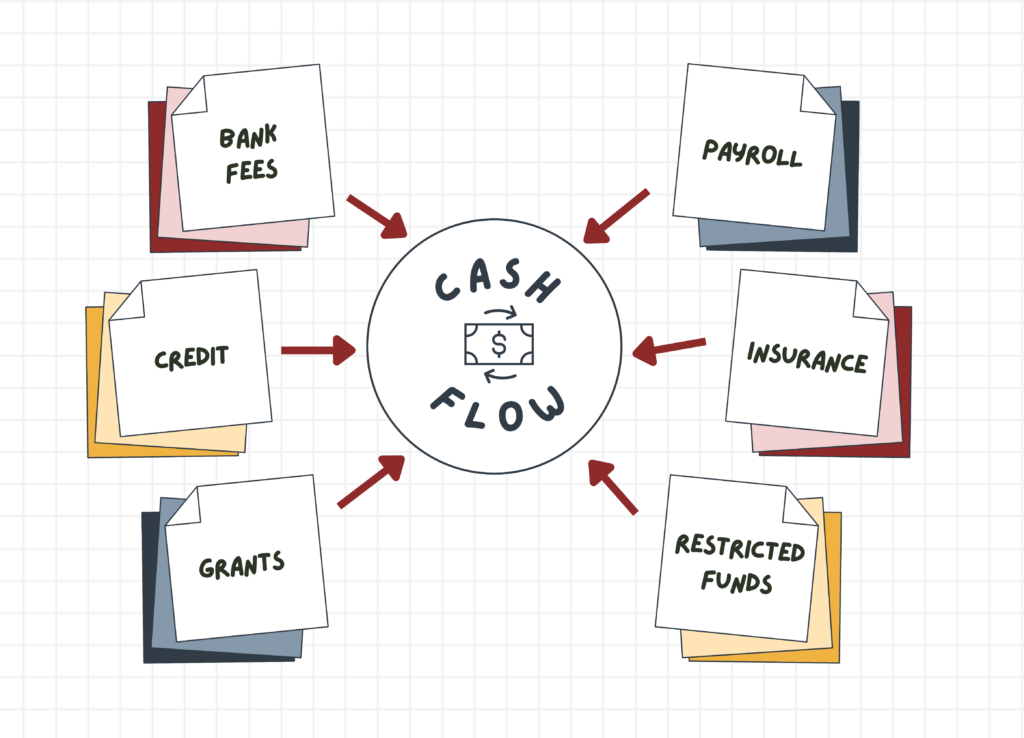

Cash flow management in any organization is nothing more than the mix and timing of cash receipts and cash payments. In its most simplistic form, it is cash in and cash out and, ultimately, it is where budgets, projections and forecasts meet reality.

It is critical to ensuring that funds are available to pay the expenses of the organization as they come due, and it starts with predictions of how much and when cash will be received and spent. To be most effective, it should be done on a month-by-month basis going as far out as the end of the fiscal year, if not an entire 12 months.

CASH OUT

With good financial reporting, cash out can be estimated easily. Payroll, usually the largest expense for a nonprofit, has a defined payment schedule with amounts that remain consistent pay period after pay period unless the nonprofit is adding or reducing staff. Health insurance, another large expense, has relatively the same monthly premium every month for a year. Rent and utilities remain largely unchanged.

Programmatic costs, on the other hand, may vary wildly, particularly if the organization is involved in seasonal events or performances. With a knowledgeable staff and a little bit of historical data, however, even programmatic costs can be easily projected.

CASH IN

Cash receipts are far more challenging in a nonprofit environment. Unlike commercial entities, nonprofits cannot rely on selling goods and services with net 30-day payment terms. Instead, they are subject to foundations, governments, and donors, all of which have their own unique cash flow issues.

Consequently, it is not uncommon to have seasonal revenue streams which must be managed tightly during active months to keep cash available for less active periods of the year. A line of credit can help manage leaner times; however, it should not take the place of good budgeting and financial performance.

Nonprofits can, and should, budget for an operating surplus every year. When budgets are met, that surplus will provide cash reserves or allow for capital expenditures.

RESTRICTED CASH

Often cash received is earmarked by donors for specific purposes. This should be tracked and monitored separately and only spent on expenses related to the donors’ specifications. Too often organizations take cash from one overfunded restriction and devote it to another that is underfunded, or they inadvertently use restricted cash for operating expenses.

Spending restricted funds on anything outside of the prescribed uses can have serious consequences–that is why leaders of nonprofit organizations should be attuned to how much cash is restricted. The Statement of Financial Position (SOFP) and, more specifically, the net asset rollforward schedule is an excellent tool to determine this. It reflects two categories: Net assets without donor restrictions and net assets with donor restrictions. If the organization’s accounting team is closing the books monthly, these numbers should be readily available and accurate.

GOVERNMENT GRANTS AND CONTRACTS

Government grants and contracts also come with funding restrictions. The related documentation will dictate how the revenue from those sources can and should be spent. Someone within the organization needs to be well versed in the terms to ensure that cash is utilized in accordance with the contract.

CASH FLOW IS A TEAM EFFORT

Good cash flow management is a team effort. Although it is generally led and managed in Finance or Accounting, it involves input from all departments.

Program and human resources staff are best positioned to help with the timing of expenses. The fundraising team knows the most about the timing of grant payments and donor gifts. Contract managers can weigh in on reimbursement schedules. Team members working on earned income projects can estimate billing and collections.

Ultimately, all this data should flow to the Director of Finance, or similar position, so that cash on hand can be projected and potential shortfalls can be managed. If revenue appears to be coming in under budget, staff can be involved in proposing annual budget modifications to preserve good financial health.

The best cash flow management is transparency. It happens when leadership is provided with reliable financial data on a regular basis that guides and allows the organization to pivot, as necessary. The healthiest organizations are those in which the entire team is working toward the same end, programmatically as well as financially.

Are you looking for assistance managing your cash flow? We would love the opportunity to discuss how we can help.

Share This Post:

Chazin

With over 20 years working exclusively with nonprofits, we pride ourselves in having a unique understanding of nonprofit accounting needs. We believe that nonprofits deserve personalized, quality service and should not settle for a one-size-fits-all approach. We collaborate with you to provide a fully virtual and customized solution that is not only cost-effective but also strengthens your accounting function. We offer a team of industry experts at your disposal to provide advice, leading technology, and to supplement existing staff to improve efficiency and compliance.