In the first installment in this series, we provided an overview of the importance of accounting and financial management for nonprofit organizations. As you embark on your journey to create a thriving nonprofit, understanding internal controls becomes crucial. In this second blog post, we will demystify internal controls, highlighting their importance in preventing errors, ensuring compliance, and protecting your organization’s financial assets.

The Role of Internal Controls

Internal controls encompass a set of policies, procedures, and practices designed to protect an organization’s assets, ensure accurate financial reporting, and promote adherence to laws and regulations. For nonprofits, internal controls play a pivotal role in preventing accounting mistakes, identifying issues, and safeguarding against fraud.

Importance of Policies, Procedures, and Internal Controls

- Preventing errors: By segregating duties and implementing checks and balances, internal controls reduce the risk of errors in financial reporting. Accurate and reliable financial data is essential for making informed decisions and gaining the trust of stakeholders.

- Identifying problems: Well-defined procedures allow you to identify and address issues promptly. Regular financial reviews and audits help you spot discrepancies, ensuring that corrective actions are implemented promptly to rectify any problems.

- Fraud prevention: Nonprofits are not immune to fraudulent activities. Effective internal controls help to mitigate the risk of fraudulent behavior and provide a strong line of defense against financial misappropriation.

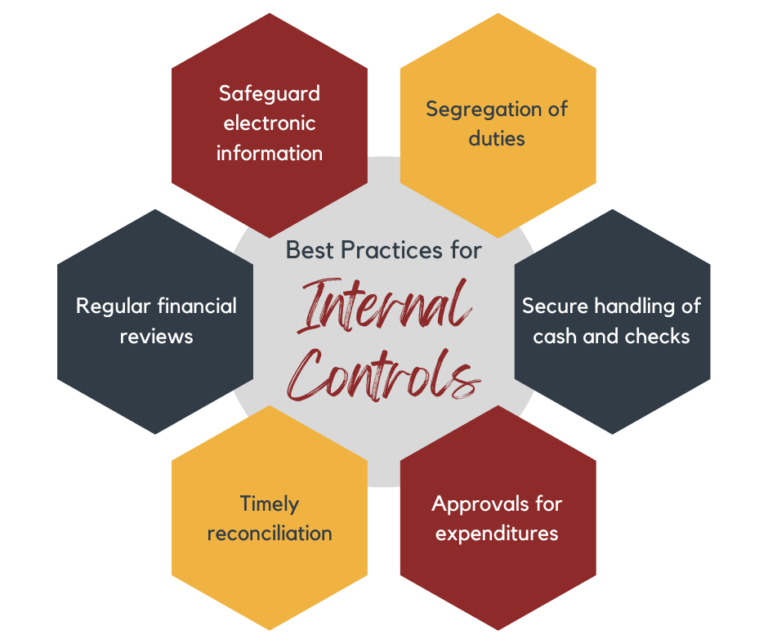

Best Practices for Internal Controls

- Safeguard electronic information: In the digital age, protecting electronic financial information is vital. Invest in secure systems and educate staff on data security best practices. Implement authority protocols to limit access to confidential data and to limit who may edit and delete data.

- Segregation of duties: Avoid concentrating financial responsibilities in the hands of one individual. Separate the duties of receiving, recording, and reconciling financial transactions to minimize the risk of fraud. While this can be a challenge for small and start-up nonprofits, as the organization grows the opportunities increase for greater segregation of duties.

- Secure handling of cash and checks: Implement strict protocols for handling cash and checks. Ensure that all funds are promptly deposited into the organization’s bank accounts and that cash and checks on hand are kept secure.

- Approvals for expenditures: Set spending limits and establish procedures for authorizing expenditures. This ensures that expenses are approved by authorized personnel and align with your nonprofit’s goals.

- Timely reconciliations: Regularly reconcile bank accounts, financial statements, and other financial records to identify and rectify discrepancies and errors promptly.

- Regular financial reviews: Conduct periodic reviews of financial records to identify unusual patterns and monitor the financial health of your organization. At a minimum, CEOs should review all monthly bank statements and every payroll summary for irregularities. Your board of directors should review financial statements at least quarterly for the organization’s and their own protection. Regular reviews help you catch potential issues before they escalate.

Wrap-Up

Internal controls form the backbone of your nonprofit’s financial health. By implementing policies, procedures, and best practices, you reduce the risk of errors and fraud while promoting transparency and accountability. Remember, strong internal controls are not only about protecting your organization from financial harm but also about building trust with stakeholders. In the next blog, we will delve into the vital role of transaction tracking for nonprofits.

NFP SmartStart

Built specifically for small and/or start-up nonprofits. NFP SmartStart provides accounting best practices, compliant processes, accurate financial data, and meaningful reporting, to help you lead your organization to the next level.

Read the Full Series

Stepping Stones: Paving the Path to Long-Term Financial Success

The Power of Financial Transparency

More Than Just Taxes: Why Nonprofits Need to File Returns

The Vital Role of Transaction Tracking

Understanding the Role of Internal Controls

Share This Post:

Chazin

With over 20 years working exclusively with nonprofits, we pride ourselves in having a unique understanding of nonprofit accounting needs. We believe that nonprofits deserve personalized, quality service and should not settle for a one-size-fits-all approach. We collaborate with you to provide a fully virtual and customized solution that is not only cost-effective but also strengthens your accounting function. We offer a team of industry experts at your disposal to provide advice, leading technology, and to supplement existing staff to improve efficiency and compliance.