We would like to take the time to express how grateful we are for our staff, clients, partners, and friends. Thank you for your trust and confidence in us. Book a Consultation…

Tag: Nonprofit Accounting

Join Us for Our Fund Management Webinar

Many churches have received generous and faithful gifts for a variety of needs. Often these financial gifts are designated to a specific activity or undertaking ‒ meaning the parish or cathedral created a fund to identify and restrict the use of these gifts. Some churches end up with hundreds of donations that the faithful have…

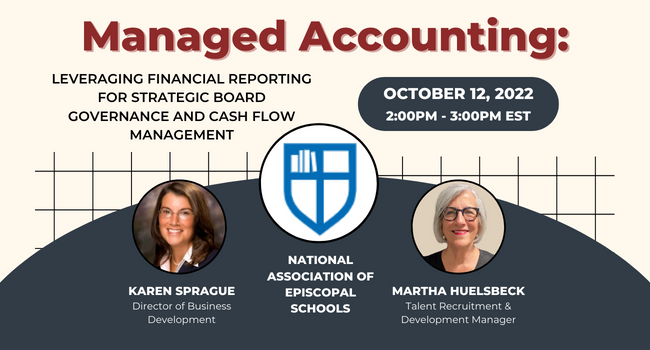

Join Us for Our Managed Accounting Webinar

Do your Board and Committee meetings get bogged down in detailed financial discussion? Do you wish your financial reports could lead you to more strategic Board discussions? Often reports provided to school Boards and committees are overly detailed and lead the Board to focus more on day-to-day spending decisions and less on higher level strategy…

[Announcement] Chazin & Company’s Best of Accounting Awards

Chazin & Company is pleased to announce that it has recently earned two awards from ClearlyRated – Best of Accounting Client Satisfaction 2022 and Best of Accounting Employee Satisfaction 2022. Many thanks to our clients and employees for taking the time to complete your satisfaction survey. Your honest feedback is appreciated and will help us…

[Announcement] Introducing Counting On Chazin

We’ve partnered with the American Nonprofit Academy to create this one-of-a-kind video and podcast series exclusively for nonprofits. Each episode features nonprofit accounting experts discussing some of the most important accounting and finance topics today. Click below and get started! PLAY NOW…

Why Numbers Matter to a Nonprofit Board

For Nonprofit Boards, Numbers Are a Necessity As a Board member for a nonprofit organization, you’re expected to attend Board meetings, monitor fundraising and management, digest reports, and help the organization determine its strategic direction. You’re also expected—and, indeed, compelled by law—to oversee the organization’s finances as part of the fiduciary responsibility of a Board. …

[Case Study] Parish Drives 22% Increase in Donations with Sage Intacct

After falling behind on annual audits, St. Columba’s recognized it was time to make a change and brought in a team from Chazin. The Sage Intacct Accountants Program partner conducted a full assessment of St. Columba’s financial operations and recommended specific next steps to revamp the Church’s processes. Chazin streamlined the Church’s chart of accounts,…

The Chazin Way

How can an accounting partner help your nonprofit overcome common challenges? The world of nonprofits is comprised of many different types of organizations. All 501c organizations face challenges that are unique to the nonprofit sector. One thing that all nonprofits have in common is the need for high-level accounting and financial oversight. Not having your…

LIVE Workshop with the Episcopal Parish Network

In a hectic world, church leaders are seeking ways to maximize efficiencies while maintaining top-level results (including finance and accounting processes). The emerging post-COVID world, finds many churches facing stretched resources – both fiscal and physical. Many lay and clergy leaders are exploring engaging outside expertise to handle accounting and finance functions, realizing the cost-savings…

3 Keys to Being Prepared for Your Next Nonprofit Audit

For many nonprofits, going through an annual audit is like undergoing a root canal—it’s a painful, stressful, and expensive experience. The good news is that it doesn’t have to be that way (the audit, that is.) Through advance planning, organization, and knowledge of the audit requirements, nonprofits can embark on their annual audit with ease and…