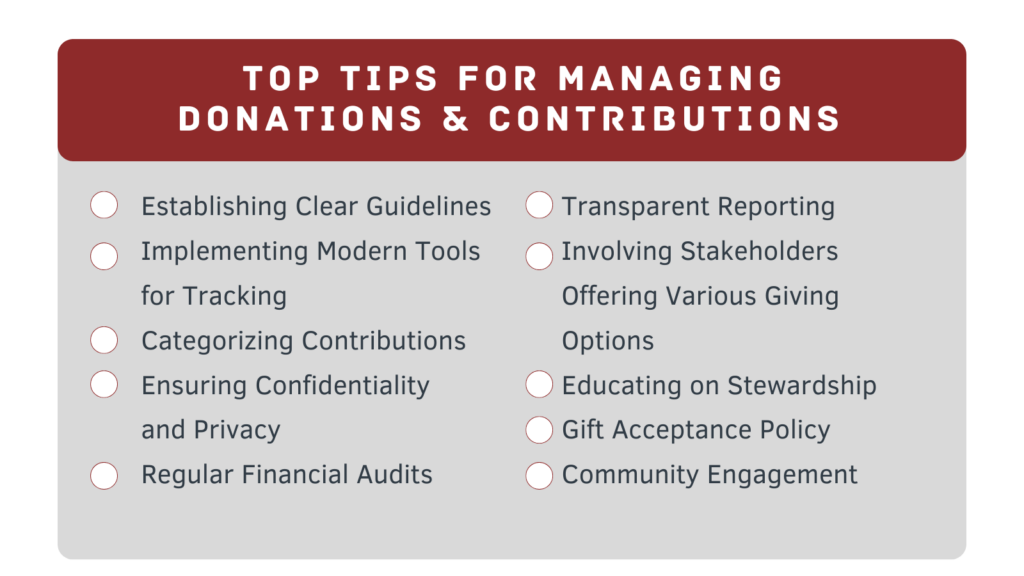

In the realm of faith-based nonprofits, effective management of contributions is essential for sustaining the mission, growth, and impact of the organization. With a focus on maintaining transparency, accountability, and proper stewardship, faith-based organizations can navigate the complexities of financial management while fostering a strong sense of community. In this guide, we will delve into best practices for managing donations and contributions, covering areas such as donation tracking, reporting, and ensuring transparency with congregants.

1. Establishing Clear Guidelines

A solid foundation begins with well-defined guidelines for financial contributions. Clearly communicate the purpose and benefits of contributions to stakeholders. Provide information on how these funds are used to support the church’s or organization’s activities, community initiatives, and charitable efforts. Transparent communication builds trust and encourages individuals to contribute willingly.

2. Implementing Modern Tools for Tracking

Effective management starts with accurate and efficient tracking of contributions. Consider utilizing modern software or financial management platforms, such as REALM, ACS OnDemand, Shelby, QuickBooks, and SAGE Intacct, to maintain a detailed record of all financial transactions. Chazin’s Nonprofit Accounting Specialists are familiar with these software solutions and have clients who use them. These tools, coupled with our expertise, can streamline the process, reduce errors, and enhance the overall management of funds.

3. Categorizing Contributions

Categorize contributions to better understand how funds are allocated. This practice helps in creating comprehensive reports, ensuring that resources are directed to specific areas of need, such as maintenance, community outreach, or charitable projects.

4. Ensuring Confidentiality and Privacy

Respect the confidentiality and privacy of contributors. While transparency is important, it is equally vital to maintain the anonymity of those who choose to remain unidentified. Protecting personal information fosters a sense of security and encourages more individuals to participate in the act of giving.

5. Regular Financial Audits

Periodic financial audits are important for maintaining integrity and transparency within faith-based organizations. Conducting regular audits by independent professionals ensures that funds are managed according to established guidelines and that there is no misappropriation. Audits also help identify areas for improvement in financial management processes.

6. Transparent Reporting

Generate comprehensive reports on the allocation and utilization of contributions, showcasing the church’s or organization’s commitment to transparency. These reports offer detailed insights into how stakeholders’ financial support has been put to use and the positive outcomes it has facilitated. For instance, one report might outline the percentage of funds directed toward maintaining the community center, including utility costs, maintenance, and improvements. Another report could delve into the financing of educational programs, featuring statistics on the number of scholarships awarded and the impact on students’ lives.

7. Involving Stakeholders

Encourage stakeholders to actively participate in the management process. Seek input and suggestions on how funds should be allocated for specific projects or causes. This could include hosting open forums, committees, interactive workshops, small group discussions, and feedback surveys. This level of involvement fosters a stronger sense of ownership, as individuals feel that their opinions are valued and considered in financial decisions.

8. Offering Various Giving Options

Diversify giving options to cater to different preferences. Provide multiple channels for contributions, including online platforms, mobile apps, and in-person donations. Accommodating various methods simplifies the process for contributors and encourages broader participation but keep in mind that not all platforms offer the necessary controls to ensure proper accounting compliance standards so please consult with your trusted accounting partner before selecting an online platform.

9. Educating on Stewardship

Promote the concept of stewardship among members or supporters. Encourage responsible financial management, emphasizing the importance of giving within one’s means. Provide educational resources on budgeting, managing debt, and making informed financial decisions. By nurturing good financial practices, you empower members and supporters to contribute thoughtfully and sustainably.

10. Gift Acceptance Policy

This policy must elucidate the various categories of donations that the organization or church is open to receiving, along with stipulated minimum amounts and the intended utilization of these contributions. Additionally, for wider accessibility, it is advisable to make this policy readily available, potentially by featuring it on your website’s donation page.

11. Community Engagement

Beyond financial transactions, cultivate a sense of community engagement. Organize events, workshops, and gatherings that allow supporters and members to witness the impact of their contributions firsthand. Connecting people with the tangible outcomes of their generosity deepens their emotional investment and strengthens the sense of community within the organization.

In conclusion, effective management of contributions is a cornerstone of maintaining the vitality of faith-based nonprofits. By implementing clear guidelines, modern tracking tools, transparent reporting, and fostering community engagement, these organizations can nurture a culture of responsible stewardship and philanthropy. Upholding these practices ensures that the contributions serve their intended purpose of uplifting both the church or organization and the wider community it serves.

Share This Post:

Chazin

With over 20 years working exclusively with nonprofits, we pride ourselves in having a unique understanding of nonprofit accounting needs. We believe that nonprofits deserve personalized, quality service and should not settle for a one-size-fits-all approach. We collaborate with you to provide a fully virtual and customized solution that is not only cost-effective but also strengthens your accounting function. We offer a team of industry experts at your disposal to provide advice, leading technology, and to supplement existing staff to improve efficiency and compliance.