In an environment of rising costs, shifting funding sources, and heightened accountability, nonprofit financial health depends on more than good intentions—it requires disciplined planning. A well-constructed nonprofit budget is one of the most powerful tools leaders have to translate mission into action, align resources with priorities, and anticipate financial risk before it becomes a crisis.

Unlike a static forecast, an effective budget serves as a strategic framework for decision-making. It helps nonprofits navigate economic uncertainty, respond to evolving community needs, and maintain long-term sustainability. By approaching budgeting as an ongoing process, organizations can strengthen financial resilience, improve stewardship, and position themselves to deliver greater impact—today and in the years ahead.

Why is a Budget Important For Your Nonprofit?

When you establish a budget for your nonprofit, you ensure that your organization uses its financial resources wisely, aligning spending with its values and objectives. Without a formal budget, it becomes challenging to monitor how and where funds are expended. A budget provides a structured framework for your nonprofit’s goals and strategic planning, offering an opportunity to identify and address potential spending inefficiencies within the organization.

A well-prepared budget strengthens financial judgement for nonprofit leaders and boards, enabling them to respond proactively to financial challenges and opportunities.

What's Included in a Nonprofit Budget?

Whether you are creating a nonprofit budget independently or with the support of your organization’s accountant and finance department, a standard nonprofit budget comprises two primary components:

- Revenue: Your nonprofit’s revenue encompasses all incoming funds, such as grants, donations, sponsorships, and event proceeds. Historical financial data can be used to project revenue for the budget year from each funding source, allowing you to allocate resources accordingly.

- Expenses: The expenses section of your nonprofit budget typically lists the costs for the current year, which can be categorized into overhead and program expenses.

- Overhead expenses include administrative and fundraising costs, representing the day-to-day expenses of running your organization.

- Program expenses are related to the direct execution of the programs and services your organization provides.

Together, revenue and expenses form the foundation of every nonprofit budget—but understanding these categories is only the starting point. A clear view of how funds are generated and deployed assists nonprofit leaders in evaluating trade-offs, prioritizing mission-critical activities, and identifying potential financial risks before they impact operations.

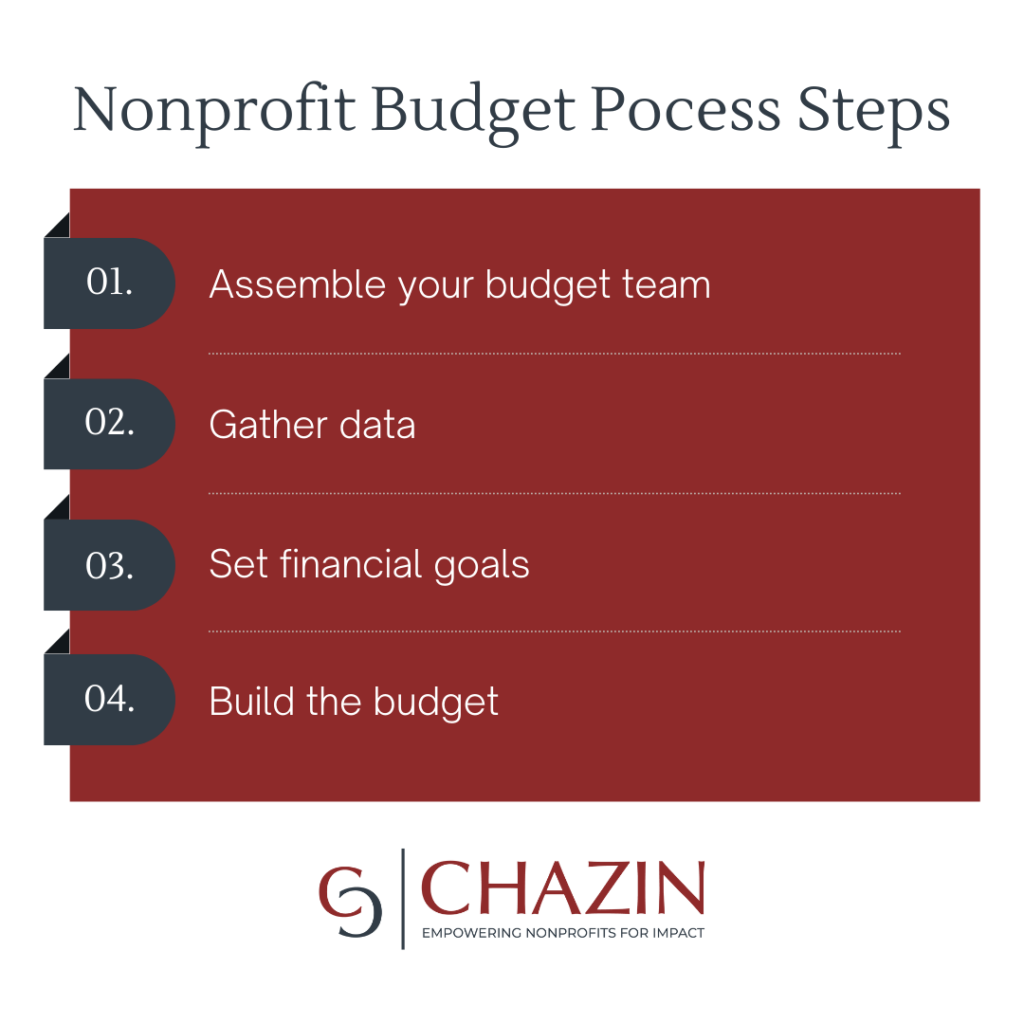

Nonprofit Budget Process Steps

Follow these general guidelines when crafting your nonprofit budget:

- Assemble your budget team: Your budget team should include members from within your organization, such as the CEO, CFO, Development Director, Department and Program Managers, and Board Members. Ensure that all team members are engaged and have an opportunity to provide input in the budgeting process.

- Gather data: Review the current and previous year’s financial data, identify trends, and gather input from stakeholders, including the Board, department leadership, and program staff. This collaborative approach ensures a comprehensive and informed budget development process.

- Set financial goals: Define your organization’s financial goals and incorporate them into your budget. By estimating the costs associated with achieving these goals, you create a plan to turn aspirations into actionable strategies.

- Build the budget: While various nonprofit budget templates are available online, consider reaching out to an experienced nonprofit accountant to help design a budget tailored to your organization’s specific needs. Expert guidance can identify cost-saving opportunities and streamline your budget.

Budgeting Today for Tomorrow's Opportunities

A thoughtful budgeting process is not simply an administrative requirement—it is a critical driver of nonprofit financial health and long-term impact. When approached strategically, a budget becomes a living tool that supports informed decision-making, strengthens accountability, and helps organizations remain resilient amid uncertainty. Strong budgets enable nonprofit leaders to balance today’s operational demands with tomorrow’s opportunities, ensuring resources are deployed where they matter most.

Ultimately, budgeting is about stewardship and is a fundamental step toward allocating resources to fulfill the mission. By aligning financial planning with mission priorities, nonprofits are better equipped to adapt to change, build trust with stakeholders, and sustain the programs and services their communities rely on.

For organizations looking to strengthen their budgeting practices, the right financial partnership can make the process more effective and less burdensome. Chazin works alongside nonprofits to support sound budgeting and broader financial management through tailored accounting and financial leadership services. If you’re evaluating how your budgeting process supports your mission, we invite you to explore our insights and resources—or reach out to start a conversation.

Share This Post:

Chazin

With over 20 years working exclusively with nonprofits, we pride ourselves in having a unique understanding of nonprofit accounting needs. We believe that nonprofits deserve personalized, quality service and should not settle for a one-size-fits-all approach. We collaborate with you to provide a fully virtual and customized solution that is not only cost-effective but also strengthens your accounting function. We offer a team of industry experts at your disposal to provide advice, leading technology, and to supplement existing staff to improve efficiency and compliance.