Today’s nonprofits face high expectations for impact amid rising costs and unpredictable revenue. A staggering 77% of organizations saw an increase in program and service demand in 2025, which was especially difficult to meet for the 36% of nonprofits that ended the previous year with an operating deficit.

To navigate this gauntlet, nonprofits need financial expertise and strategic support now more than ever. When nonprofits invest in tactful financial management, they increase organizational credibility and, as a result, support from the communities they serve.

A foundational best practice of good financial management is having a nonprofit chief financial officer (CFO), who guides your organization’s financial efforts, taking into account operational needs and strategic planning. Whereas core accounting and bookkeeping functions are inherently retrospective, a nonprofit CFO plays a vital, forward-looking role, involving future risk assessment, long-term sustainability guidance, financial scenario modeling, and proactive decision-making to keep your mission moving forward.

In this guide, we’ll cover the unique and critical role of a nonprofit CFO in the following topics:

What Is A Nonprofit CFO?

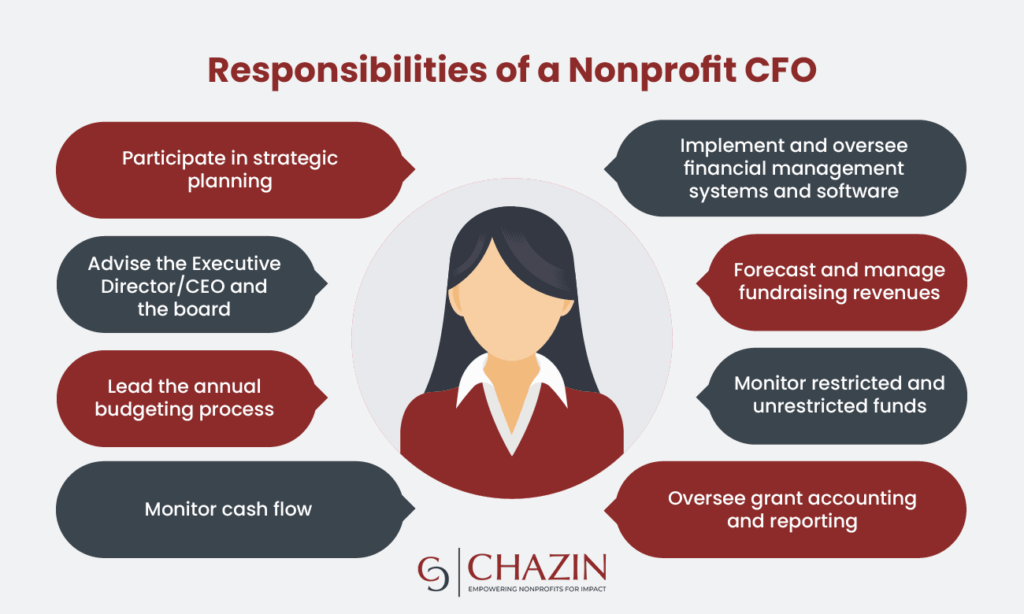

A nonprofit CFO is a financial executive who manages an organization’s financial strategy, focusing on high-level responsibilities that impact the nonprofit’s overall success. In line with these responsibilities, a nonprofit CFO might:

- Participate in strategic planning

- Advise the Executive Director/CEO and the board

- Lead the annual budgeting process

- Monitor cash flow

- Implement and oversee financial management systems and software

- Work with development or advancement to forecast fundraising revenues

- Monitor restricted and unrestricted funds

- Oversee grant accounting and reporting

Ultimately, nonprofit CFOs are responsible for anticipating what lies ahead, especially during periods of organizational growth and economic uncertainty. This foresight ensures sustainable scaling during times of growth and proactive risk mitigation when funding is unpredictable.

Just as it’s important to know what a nonprofit CFO is, it’s also important to know what this role is not. In fact, each distinct member of a nonprofit’s financial team must work together seamlessly to ensure the CFO can effectively do their job. Here’s how these roles differ:

- CFO: A strategic leader who oversees financial operations and connects finances to the organization’s mission

- Controller or Senior Accountant: A technical expert who manages data analysis and reporting, including creating financial statements and reconciling bank accounts

- Accountant: A recordkeeper who handles daily transactions and keeps financial data organized

- Treasurer: A member of the nonprofit’s board who provides financial oversight at the governance level

Ideally, your nonprofit should fill each of these roles to create a holistic financial team that collaborates to align all of the organization’s financial and leadership activities.

Types of Nonprofit CFOs

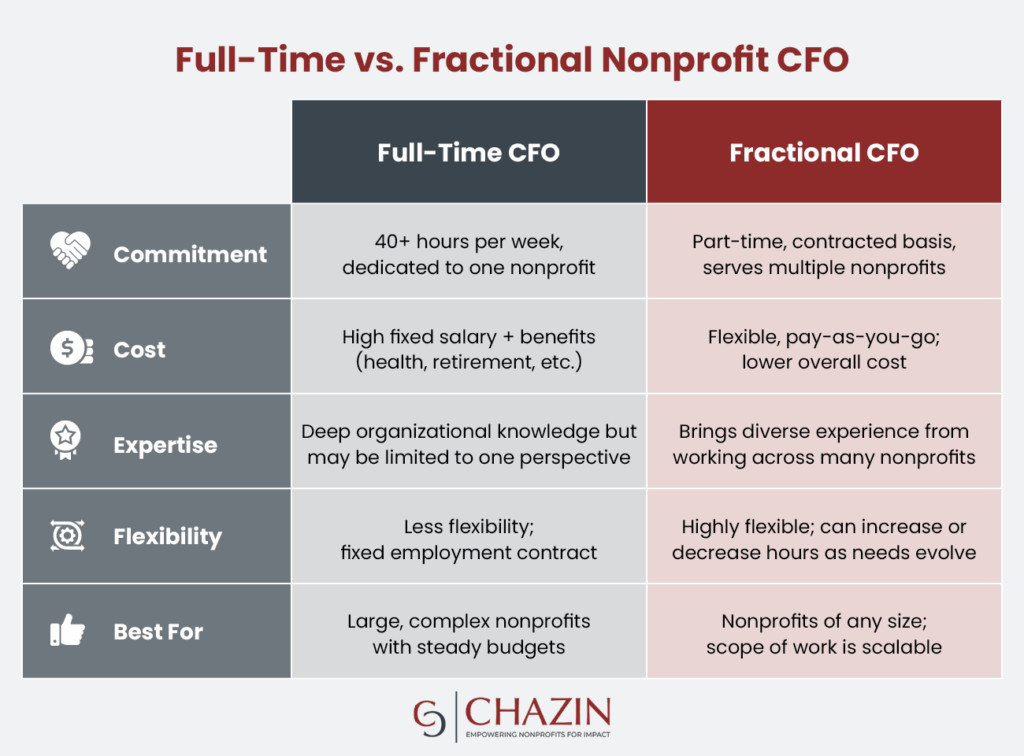

While all nonprofit CFOs generally have the same responsibilities, their exact roles may differ according to the scope for which they’ve been hired. In this sense, there are two types of nonprofit CFOs: full-time and fractional.

Full-time CFOs are in-house financial executives who are part of your organization’s permanent staff. Here’s a summary of their position:

- Commitment: 40+ hours per week, dedicated to one nonprofit

- Cost: Fixed salary and benefits, like health insurance and a retirement plan

- Expertise: Deep organizational knowledge, but may be limited to one perspective and may not be strong in issues unique to nonprofit accounting

- Flexibility: Less flexibility; fixed employment contract

- Best for large, complex nonprofits with steady budgets

Fractional CFOs, in contrast, are outsourced experts with deep nonprofit financial knowledge working on a part-time or as-needed basis. These individuals often assist nonprofits for a defined period of time, such as during board season, year-end financials, or a budgeting cycle. For example, Chazin’s team supported one organization through a crucial four-month transition, guiding their budgeting process, advising their board, and onboarding a new full-time CFO.

Here’s a summary of a fractional CFO’s position:

- Commitment: Part-time, contracted basis, serves multiple nonprofits

- Cost: Flexible, pay-as-you-go; lower overall cost

- Expertise: Brings diverse experience from working across many nonprofits. Highly trained in unique nonprofit accounting issues.

- Flexibility: Highly flexible; can increase or decrease hours as needs evolve

- Best for nonprofits of any size; scope of work is scalable

Generally, hiring a fractional CFO has numerous benefits over an in-house CFO. Outsourced CFOs bring an objective perspective, unclouded by personal attachment to the nonprofit’s mission and goals.

Also, fractional CFOs offer scalable services, meaning your nonprofit can adjust their roles over time as you need to increase or decrease their responsibilities. Unlike accounting services, which nonprofits usually price-shop based on deliverables, CFO services are differentiated by the quality of analysis and insights. Their independence serves to strengthen the organization’s internal controls.

Current Nonprofit CFO Trends to Consider

As nonprofits face evolving financial realities, the landscape for CFOs is also changing. To make sure your organization finds the right partner for its needs, you’ll need to understand the current state of nonprofit finances and align your hiring priorities accordingly.

Here are some trends to consider:

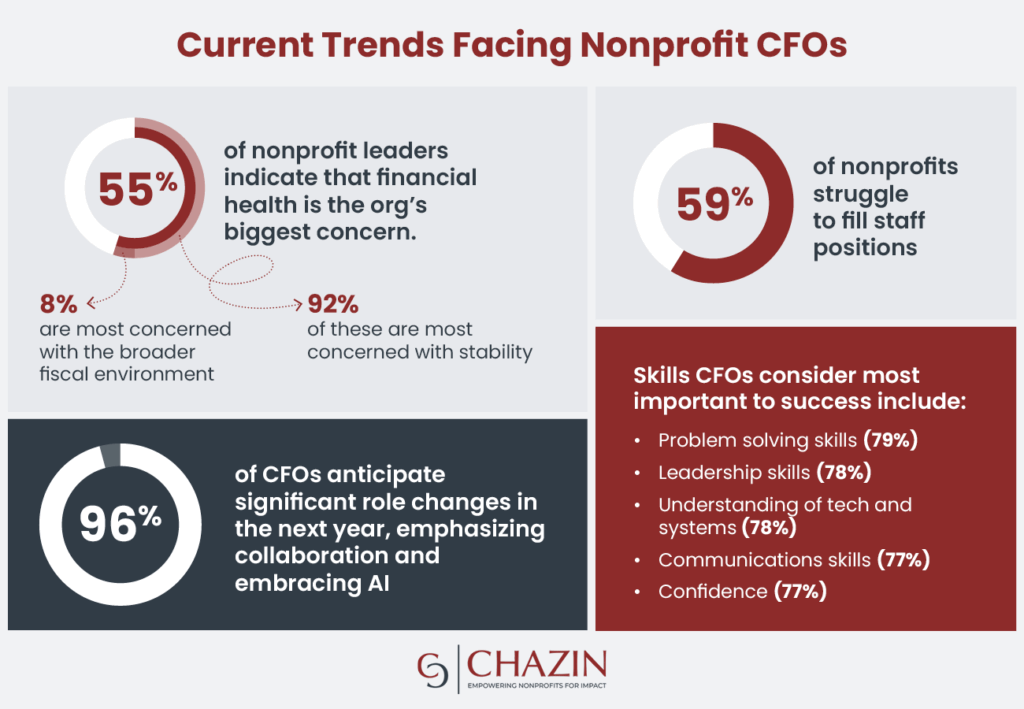

- Financial stability is a top priority. 55% of nonprofit leaders indicate that financial health is their organization’s biggest concern. Of these financial concerns, stability is the primary focus (92%), while the broader fiscal environment weighs on the rest.

- Staffing shortages remain a major challenge. 59% of nonprofits struggle to fill staff positions, and job vacancies are especially prevalent in the finance department. The Chronicle of Philanthropy reports that candidates with financial expertise are in high demand and short supply, underscoring the potential benefits of outsourcing CFO services.

- The CFO position is expanding. According to Sage’s finance-leader research, 96% of CFOs anticipate significant role changes in the near future. More specifically, changes are expected around cross-departmental collaboration and AI adoption.

- Key skills define success. Sage’s research also details the skills that nonprofit CFOs believe are most important to success in the role. Nearly 8 in 10 highlighted the following skills as essential for thriving in today’s nonprofit environment:

- Problem-solving skills (79%)

- Leadership skills (78%)

- Understanding of technology and systems (78%)

- Communication skills (77%)

- Confidence (77%)

At Chazin, we see these trends among our clients every day. Many nonprofits find themselves at a growth stage where a full-time CFO isn’t yet economically viable—for example, requiring only 10-15 hours of support weekly.

These trends highlight a common theme: the need for critical financial skills and expertise. A fractional CFO offers an efficient solution, delivering high-level expertise without committing to the full cost of in-house leadership. As such, selecting and hiring a nonprofit CFO requires careful consideration.

How to Select the Right Nonprofit CFO

Hiring a nonprofit CFO is a pivotal decision, as the right financial leader sets the stage for your organization’s stability and growth. Here are the steps you should take to ensure you choose the right partner.

1. Determine Your Nonprofit’s Needs

Assess whether your organization needs a full-time or fractional CFO. To make this distinction, evaluate your nonprofit’s:

- Budget: Do you have the capacity to provide a salary and benefits to a full-time CFO? Or, would outsourcing provide a much-needed service at a more affordable rate?

- Size: Larger nonprofits with more complex budgets typically hire in-house CFOs. Remember that outsourced CFOs offer scalable services, so organizations of any size can leverage an external CFO’s services at the involvement level they need.

- Complexity: Is your team looking for a daily partner, a high-level strategic advisor, or an expert to weigh in on an as-needed basis? Full-time CFOs are available for daily work, while outsourced CFOs can be involved in whatever capacity your team needs.

Remember that a fractional CFO is more flexible, providing benefits for organizations of various budgets, sizes, and complexity levels. As an organization grows in size and complexity, the CFO role can evolve—either expanding the existing fractional engagement or transitioning into a full-time, in-house position.

Even if your nonprofit hires a full-time CFO later down the line, many organizations find it useful to outsource CFO services in the critical “growth bridge” period, during which nonprofit development brings about financial complexities that necessitate CFO intervention.

2. Look For Key Criteria

Next, set clear criteria for the skills and experience you’re looking for in a nonprofit CFO. Use this list of standards to guide your search for the ideal CFO candidate:

- Experience in the nonprofit sector: Look for a CFO who is familiar with the unique nonprofit financial landscape. For example, a strong candidate understands donor restrictions, state and federal regulations, and general nonprofit accounting best practices.

- Software or technology familiarity: Whether your organization budgets with spreadsheets or dedicated accounting software, your CFO should be able to leverage that software or recommend even more useful solutions that will better serve your team.

- Strategic financial skills: An effective CFO can create financial forecasts, conduct risk assessments, and otherwise provide long-term, high-level advice beyond simply reviewing and reporting financial information.

- Collaboration: Many stakeholders depend on your nonprofit’s financial health, from donors to beneficiaries. Therefore, your CFO should be able to translate complex financial concepts into clear insights for those who aren’t financial experts.

Brainstorm and include any other criteria specific to your organization. Consider ranking these standards by level of importance to ensure the candidate you choose is as close a match as possible.

3. Ask The Right Questions

Your nonprofit shouldn’t go without the above criteria in a CFO, but you can assess candidates beyond their technical expertise by asking the following questions:

- What key metrics do you use to measure financial health?

- What financial software are you proficient in, and how have you implemented it in previous positions?

- What are your expectations surrounding communication with our board of directors and the finance committee?

- How do you explain complex financials to non-financial stakeholders?

- What is your vision for ensuring accountability?

Remain open to answering candidates’ questions, as well. The right CFO will not just join your nonprofit’s work, but challenge it, holding your team accountable and ensuring excellence at every step.

5 Signs Your Nonprofit May Be Ready For a CFO

How do you know whether your organization has outgrown its current financial structure? If you recognize any of the following signs, you may be ready for the strategic oversight of a nonprofit CFO:

- You lack a financial roadmap for growth. Do your current financial processes focus primarily on historical reporting? Your organization needs accurate, multi-year forecasts and the ability to model different strategic scenarios.

- You’re facing increasing financial complexity. As your nonprofit scales its impact, you’ll also encounter multi-state tax issues, complex funding streams, new capital projects, or major software implementations that require an executive to lead these efforts.

- The organization’s financial stability feels uncertain. If you’re consistently worried about cash flow shortages, surprised by budget variances, or unsure of the organization’s plan for mitigating financial risks, a CFO’s intervention is critical.

- Your board requires more in-depth financial insight. There should be no questions about cash flow projections, long-term sustainability, and risk assessment that you can’t answer confidently in front of board members or your finance committee.

- You struggle to assess the financial viability of new strategic initiatives. Your organization needs financial modeling and scenario planning capabilities to evaluate major strategic decisions, such as launching a new program or undertaking a capital campaign.

Re-evaluate your financial readiness frequently to ensure your organization is always equipped with the oversight needed for strategic success. Again, working with a fractional CFO makes it easy to adjust the service you receive if, at any time, you need more or less intervention.

Final Thoughts on Nonprofit CFOs

Having the right financial leader can mean the difference between your nonprofit thriving and simply surviving. A nonprofit CFO’s influence touches nearly every corner of the organization, from daily accountability to long-term planning.

If your organization is ready to hire a CFO, start researching firms that can provide a multitude of services and fill your financial team with trustworthy experts. If you’re looking for a good starting point, talk to our team at Chazin! We’ve worked with nonprofits like yours for more than 20 years, and we’d love to share how we can meet your organization’s unique needs.