Educational outreach programs are a vital way for nonprofit organizations to engage with their communities, raise awareness about their missions, and provide valuable learning opportunities for diverse audiences. However, running effective and sustainable outreach programs requires careful planning and budgeting, especially in times of uncertainty and limited resources.

In this blog post, we will offer some practical advice on how to budget for nonprofit educational outreach programs, based on best practices and expert insights. We will cover the following topics:

- Why budgeting is important for nonprofit educational outreach programs

- How to create a realistic and flexible budget for your program

- How to allocate your resources efficiently and strategically

- How to monitor and evaluate your budget performance and impact

Why Budgeting is Important for Nonprofit Educational Outreach Programs

Budgeting is the process of estimating and planning your income and expenses for a specific period of time, usually a year. A budget is a financial document that reflects your program goals, objectives, activities, and expected outcomes. It also serves as a communication tool that helps you share your vision and priorities with your stakeholders, such as board members, staff, donors, partners, and beneficiaries.

Budgeting is important for nonprofit educational outreach programs because it helps you:

- Align your program with your organization’s mission, vision, and strategic plan

- Identify and secure the necessary funding sources for your program

- Manage your cash flow and avoid financial shortfalls or overspending

- Track and measure your program’s progress and impact

- Demonstrate your accountability and transparency to your stakeholders

- Adjust and adapt your program to changing circumstances and needs

How to Craft a Comprehensive and Adaptable Budget for Your Nonprofit Educational Outreach Program

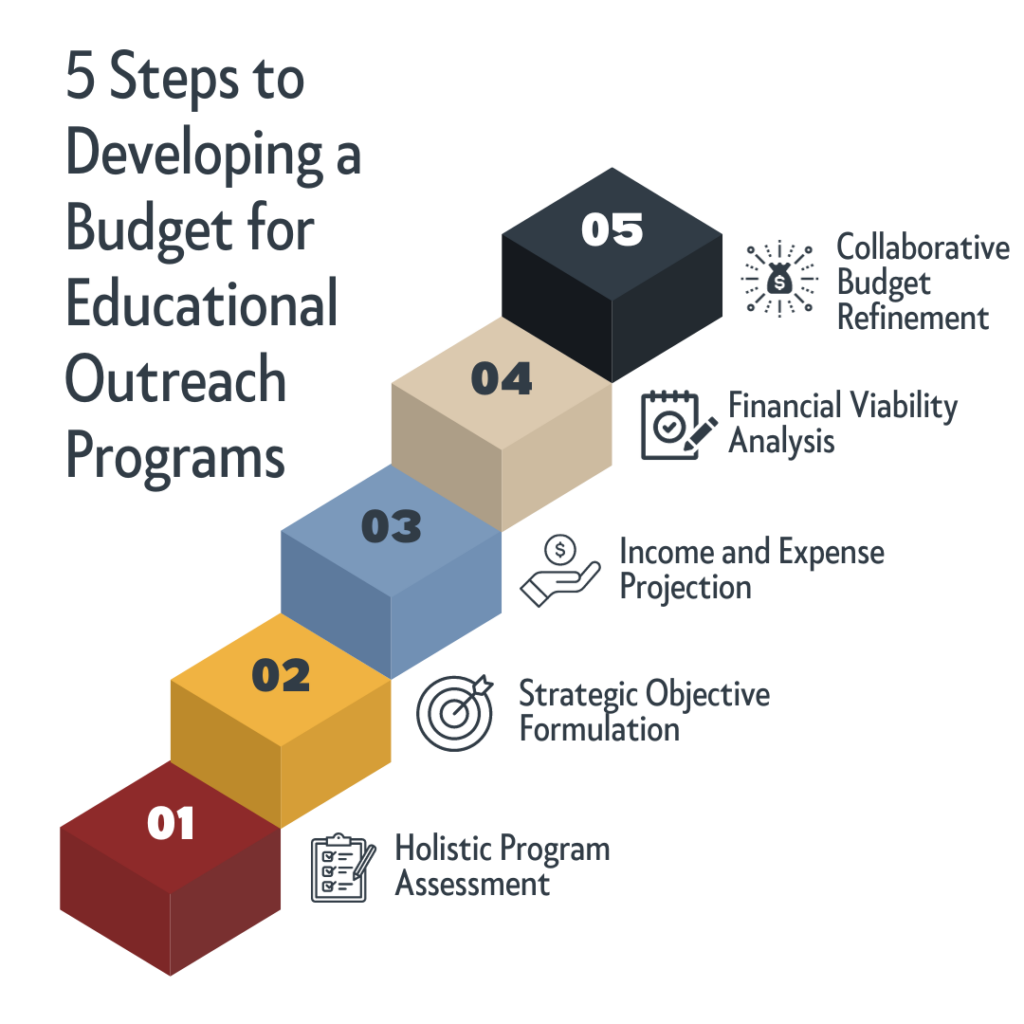

Developing a budget that is both comprehensive and adaptable for your nonprofit educational outreach program entails a multi-faceted approach. To accomplish this, follow these steps:

- Holistic Program Assessment: Begin by conducting a comprehensive assessment of your program’s past performance and current context. Scrutinize previous budgets, financial reports, and evaluation data to gain insights into your program’s strengths, weaknesses, opportunities, and challenges. Simultaneously, evaluate your current financial landscape, taking into account assets, liabilities, income streams, expenditures, reserves, and cash flow. Additionally, factor in external influences, such as the economic climate, demand for your services, competition from other providers, funding source availability, and regulatory conditions.

- Strategic Objective Formulation: Articulate clear and precisely defined goals and objectives for your program, aligning them with your organization’s mission statement and strategic plan. Ensure that these objectives are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Delineate what you aim to achieve concerning outputs (products or services delivered), outcomes (resultant changes or benefits), and long-term impact (value generated).

- Income and Expense Projection: Estimate your anticipated income and expenses with meticulous attention to detail. Based on your program’s goals and objectives, forecast income from various sources, including grants, donations, fees, sponsorships, and in-kind contributions. Similarly, project your expected expenditures across various categories like personnel, materials, equipment, travel, rent, utilities, marketing, and administration. Ground these estimates in historical data, market research, benchmarking, price quotes, and projections. Exercise prudence in your assumptions, incorporating a contingency fund to address unforeseen expenses or revenue shortfalls.

- Financial Viability Analysis: Conduct a thorough analysis by comparing your projected income to your projected expenses. Calculate your net income or net loss by subtracting total expenses from total income. Ideally, you should aim for a positive net income or, at the very least, break-even. If your net income is negative or you face a deficit where expenses surpass income, strategize ways to augment revenue or reduce expenses, or a combination of both. You can also contemplate utilizing reserves or temporary borrowing to bridge the gap, but exercise caution to safeguard long-term financial sustainability.

- Collaborative Budget Refinement: Engage in a collaborative process to review and refine your budget draft. Seek input and feedback from your program team, board members, and other stakeholders involved or impacted by your program. Encourage open dialogue to garner suggestions and secure approval. Ensure that everyone comprehends and aligns with the underlying assumptions, priorities, and trade-offs within the budget. Iterate the budget as necessary until you attain a final version that embodies realism, flexibility, and alignment with your program’s overarching goals and objectives.

How to Allocate Your Resources Efficiently and Strategically

Allocating your resources efficiently and strategically means using your money wisely and effectively to achieve your program goals and objectives. It also means making informed decisions about how much to spend on each aspect of your program, based on its importance, impact, and return on investment. Some tips on how to allocate your resources efficiently and strategically are:

- Use a program-based approach to budgeting. This means dividing your overall program budget into sub-budgets for each of your major activities or events, such as workshops, field trips, exhibitions, etc. This allows you to plan, manage, and evaluate your program at a more detailed level and to allocate your resources accordingly.

- Use a cost allocation method to distribute your indirect or shared costs among your different activities or events. Indirect or shared costs are those that are not directly attributable to a specific activity or event, such as rent, utilities, administration, etc. A cost allocation method is a formula or a rule that assigns a proportion of your indirect or shared costs to each of your activities or events, based on a relevant factor, such as staff time, space usage, number of participants, etc. This helps you to reflect the true cost of your program and to charge your funders or customers appropriately.

- Use a zero-based budgeting technique to justify your expenses for each of your activities or events. Zero-based budgeting means starting from zero and building up your budget based on the needs and benefits of each of your activities or events, rather than basing it on the previous year’s budget or the available funds. This helps you to avoid unnecessary or wasteful spending and to focus on the most valuable and impactful aspects of your program.

- Use a priority-based budgeting strategy to rank your activities or events according to their importance and urgency for your program. Priority-based budgeting means assigning a score or a weight to each of your activities or events, based on criteria such as alignment with your mission and vision, relevance to your target audience, potential for impact and innovation, availability of funding and resources, etc. This helps you to allocate your resources according to the relative priority of each of your activities or events and to make trade-offs when faced with limited resources.

How to Monitor and Evaluate Your Budget Performance and Impact

Monitoring and evaluating your budget performance and impact means tracking and measuring how well you are implementing your budget and achieving your program goals and objectives. It also means comparing your actual results with your planned results and identifying any gaps, deviations, or problems that need to be addressed. Some tips on how to monitor and evaluate your budget performance and impact are:

- Use a budget variance analysis to compare your actual income and expenses with your budgeted income and expenses for each of your activities or events. A budget variance is the difference between the actual amount and the budgeted amount. A positive variance means that you have more income or less expenses than planned, while a negative variance means that you have less income or more expenses than planned. A budget variance analysis helps you to identify the causes and effects of any discrepancies between your actual and budgeted results and to take corrective actions if needed.

- Use a cash flow statement to monitor your cash inflows and outflows for each of your activities or events. A cash flow statement is a financial document that shows how much cash you receive and spend during a specific period of time, usually a month, a quarter, or a year. A cash flow statement helps you to manage your liquidity and solvency, that is, your ability to meet your short-term and long-term financial obligations. It also helps you to plan for future cash needs and sources.

- Use a program evaluation framework to assess the effectiveness and impact of your program. A program evaluation framework is a tool that helps you to define, collect, analyze, and report data on the outputs, outcomes, and impact of your program. It also helps you to answer key questions such as: What did you do? How well did you do it? What difference did it make? A program evaluation framework helps you to demonstrate your accountability and transparency to your stakeholders, as well as to learn from your successes and failures and improve your program quality.

Budgeting for nonprofit educational outreach programs is a challenging but rewarding task that requires careful planning, management, and evaluation. By following the steps and tips outlined in this blog post, you can create a realistic and flexible budget for your program that aligns with your mission, vision, and strategic plan; allocates your resources efficiently and strategically; monitors and evaluates your budget performance and impact; and ultimately enhances your program effectiveness and sustainability.

Share This Post:

Chazin

With over 20 years working exclusively with nonprofits, we pride ourselves in having a unique understanding of nonprofit accounting needs. We believe that nonprofits deserve personalized, quality service and should not settle for a one-size-fits-all approach. We collaborate with you to provide a fully virtual and customized solution that is not only cost-effective but also strengthens your accounting function. We offer a team of industry experts at your disposal to provide advice, leading technology, and to supplement existing staff to improve efficiency and compliance.