Financial Readiness in Today’s Funding Climate

The funding landscape has shifted, and many organizations are now evaluated with early filters that focus on financial readiness, risk, and stewardship rather than the mission narrative alone.

Policy and economic changes, reduced funding, heightened competition for fewer dollars as demand for services increased, and evolving federal and donor expectations have raised the bar for what it means to be “funding ready.” Now, nonprofits are facing even more scrutiny in their financial management, planning, and sustainability.

In this environment, a for-profit mindset can be a critical advantage. Funders prioritize organizations that demonstrate strong financial stewardship, suggesting that nonprofit leaders elevate financial management from a back-office function to a core leadership responsibility.

Key Takeaways:

- Strong financial stewardship plays a major role for funders in determining which organizations are selected to receive limited funding dollars.

- Modern nonprofit financial practices extend beyond compliance to informing strategic financial leadership.

- Funders evaluate nonprofit financial stewardship, among other criteria, to assess organizational risk and sustainability.

- Strong nonprofit financial stewardship reflects leadership effectiveness and governance discipline.

- Nonprofits that align financial activities with mission strategy are positioned more competitively for funding.

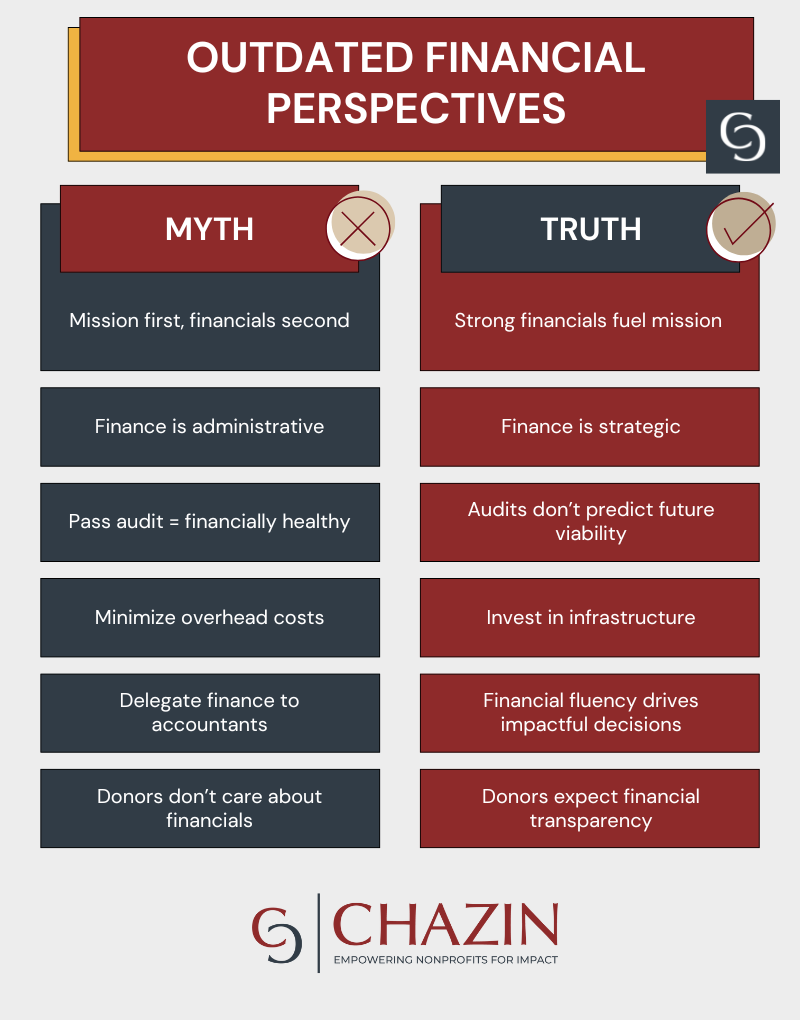

Financial Myths Funders Have Moved Beyond

Many of the attitudes nonprofit leaders hold about money, accounting, and sustainability were shaped in a very different funding environment. While these beliefs may feel mission-aligned or even protective, they no longer encompass all of the criteria that go into funding decisions today. As funder expectations rise, outdated financial myths become quiet liabilities.

Closing the gap between myth and reality requires a shift in mindset to: treating financial discipline not as a compromise to the mission but as the means to achieving your mission and protecting the sustainability of your organization.

What Funders Are Really Evaluating When They Read Your Financial Statements

Your finances tell a story—and funders know how to read it.

Your statements provide key financial indicators that can suggest an organization is stable, well-managed, and capable of delivering its commitments, or if it’s teetering on the edge of closure. Funders look for several key criteria and watch for red flags that give them pause, including:

- Liquidity and overall financial health

- Red flags: reliance on a single funder, insufficient reserves, or chronic cash shortages.

- Revenue concentration and expenses alignment

- Red flags: reliance on limited funding sources, such as grants, persistent deficits, and/or a high percentage of administrative costs relative to total expenses.

- Program sustainability relative to impact

- Red flags: funds being diverted from intended programs or programs that are significantly more expensive than what they deliver.

- Internal controls and governance discipline

- Red flags: lack of planning, overreliance on limited funding sources, or no evidence of strategic growth.

- Consistency, clarity, and timeliness of reporting

- Red flags: late, incomplete, or inconsistent financial reports, which can quickly erode funder confidence.

Credibility is built long before the proposal narrative begins. Your organization’s finances are the funder’s first impression of your nonprofit and often the deciding factor in whether they can trust your organization to steward their investment.

Building Financial Practices That Make Funders Lean In

To strengthen the story that your finances tell, organizations must demonstrate both fiscal and strategic competence. Funders gravitate toward nonprofits that can show evidence of strong financial management that aligns with the mission.

Key practices that signal confidence:

- Transparency as a trust-building tool through detailed, accurate, and timely reporting.

- Clear, documented internal controls such as segregation of duties, comprehensive budgeting processes, and regular internal reviews.

- Consistent performance metrics like revenue growth, expense management, and key ratios that reflect organizational health.

- Forward-looking financial strategy, including long-term budgeting, scenario planning, and contingency planning.

- Demonstrated revenue diversification across grants, individual giving, earned income, and partnerships.

- Explicit alignment between finances and mission, clearly articulating how financial decisions enable long-term mission deliverability.

Financially attractive organizations project preparedness, not pressure. When funders see fiscal discipline and alignment of financial practices, they lean in because they can trust your ability to carry your mission forward.

Reframing Your Mindset for Financial Discipline Without Sacrificing Mission Integrity

Accounting doesn’t compete with the mission—it protects it. Many nonprofits lose sight of their financial health to prioritize impact, but losing sight can lead to financial fragility, undermining mission delivery and scalability. Keeping a close eye on finances will ensure that you can deliver on your mission and grow into the future.

Nonprofits that embrace financial management are better positioned to attract funding, deliver programs reliably, and successfully achieve their goals. Strong financial practices enable strategic revenue planning, support data-informed decisions, and provide clarity to leaders to guide the organization.

When financial discipline is absent, even strong missions become hard to sustain. Reduced funder confidence, limited funding flexibility, and constrained leadership ability to make strategic choices all undermine the organization’s capacity to respond effectively to both opportunity and disruption.

The solution is to apply a for-profit mindset to financial management, one that is rooted in discipline, measurement, and strategy. However, unlike in for-profit businesses, this approach in the nonprofit world is not about pursuing profit at the expense of purpose; rather, it’s financial and operational rigor that will allow the mission to be sustained.

A sustainable mission is one the organization can afford to deliver year after year.

Strengthening Sustainability Through Diverse Revenue Streams

Revenue concentration is increasingly viewed as an organizational risk. This occurs when an organization relies on one predominant funding source. Although this may have been sustainable in the past, it is now viewed as a liability. A diversified revenue stream suggests less risk and greater sustainability. Nonprofits should consider the following diversification examples:

- Explore earned income opportunities

- Identify ways your nonprofit can generate revenue through fee-for-service activities, product sales, or social enterprise initiatives.

- Expand individual giving

- Programs strengthen your donor cultivation and stewardship efforts to increase recurring gifts, major donations, bequests, and legacy contributions.

- Tap into foundation and corporate grants

- Research and apply for grants that align with your nonprofit’s mission and strategic priorities.

- Develop fundraising events and campaigns

- Host engaging events, crowdfunding initiatives, and peer-to-peer fundraising to diversify your revenue mix.

- Leverage sponsorships and partnerships

- Explore mutually beneficial sponsorship opportunities and strategic alliances with aligned organizations.

- Enhance financial management systems

- Implement robust accounting practices, budgeting processes, and financial reporting to actionable insights, guide decision-making, ensure transparency, and aim toward long-term sustainability.

While diversification is the goal, it can only happen once your organization is on solid footing with a strong financial foundation.

Financial Readiness is the New Funding Prerequisite

In today’s funding environment, strong missions are no longer enough on their own. Funding criteria have strengthened as funding dollars have weakened. Nonprofit leaders who recognize this shift and combine financial readiness with their mission narrative are better positioned to compete in the demanding landscape that exists today.

A strategic, for-profit mindset—one firmly centered on mission—helps organizations build the financial stewardship funders now expect. It supports diversified revenue streams, strengthens financial health and accountability, and enables leaders to demonstrate strong management and resilience over time. More importantly, it allows organizations to plan proactively rather than operate reactively, even amid uncertainty.

For leaders navigating this shift, the question is no longer whether financial infrastructure matters, but whether yours is positioned to support sustainable funding and long-term impact. For organizations facing increasing scrutiny and complexity, experienced nonprofit financial leadership can make the difference.

Share This Post:

Chazin

With over 20 years working exclusively with nonprofits, we pride ourselves in having a unique understanding of nonprofit accounting needs. We believe that nonprofits deserve personalized, quality service and should not settle for a one-size-fits-all approach. We collaborate with you to provide a fully virtual and customized solution that is not only cost-effective but also strengthens your accounting function. We offer a team of industry experts at your disposal to provide advice, leading technology, and to supplement existing staff to improve efficiency and compliance.